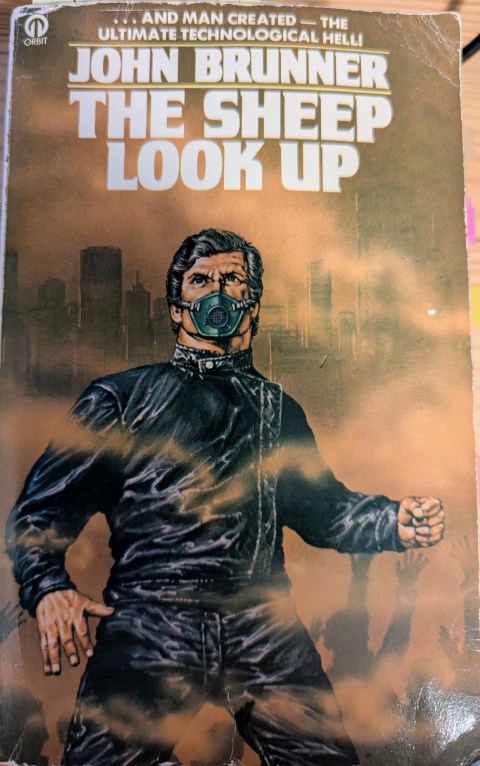

The Sheep Look Up by John Brunner, book review

Background

This book dates from 1972 and my copy is the paperback published in 1974 (left). It is just short of 500 pages and has 12 substantive chapters, each one focusing on one month in the not-too-distant future (from 1972 – now probably the past). The first two or three chapters are difficult to get into. There are a lot of characters, too many really, and each chapter flits between characters, places and events. Notes may be needed to keep abreast of characters and their fates.

The setting is the USA and some of the main action takes place in Denver (Colorado). It is worth considering what might have influenced Brunner (originally from Cheltenham, UK). The Vietnam War, for example, where both deadly defoliants were use and there was a draft. Both of these feature in this book. Moreover, on the defoliants issue, Rachel Carson’s book, Silent Spring, from 1962 clearly was within Brunner’s purview. Brunner does miss a trick on considering future communication technologies. There is no internet, for example. And no mobile phones. There is, however, problematic technology. A microwave oven cooks a baby in its mother’s womb arising from poor manufacturing and safety (unlikely, but in 1972 microwaves were not widespread).

Corporatism

The main import into the USA is oxygen. The key technology is owned by a conglomerate called Bamberley Trust and its core product is Nutripon. Nutripon was exported to “Africa” (a town called Noshri) to avert a famine. Instead of liberating inhabitants from famine it caused madness and mass killings arising from a mysterious contamination by a hallucinogen, Ergot, with a similar molecular structure to LSD. It had also been sent to Honduras. In later chapters, Ergot contaminates Denver’s water supply and violence ensues.

Bamberley Trust is headed up by the Bamberley family whose final patriarch, Roland, won’t even negotiate with the captors of his youngest son, Hector, for fear of profit loss despite being a proto-not-for-profit. It is technological determinism: “I don’t see why we shouldn’t improve on nature” Bamberley proclaims (p33). Nutripon is a hydroponically-grown, high protein cassava and is handled by Globe Relief, the world’s largest aid agency. Under the cover of Bamberley Oil, the company also makes napalm which is dumped on US citizens for no discernible reason. However, Bamberley Trust is a company that holds the population ransom. Very soon, Nutripon will be needed by American citizens as food shortages start to bite (p227). Incidentally, the president is a captured figure, familiarly known as Prexy. When the going gets tough, he declares martial law.

We learn also that insurance is a problem when the world moves from stability to insecurity/uncertainty (just as we are moving from the stable Holocene to the unstable Anthropocene). A major player in the insurance industry, Angel City Interstate Mutual, whose key character is Philip Mason, is sold after a series of environmental disasters, an enteritis epidemic as well as an avalanche caused by a sonic boom, overstretch its resources. Or maybe an earthquake. Mason failed to re-insure the Apennine Lodge (p79) and other buildings in Towerhill, exposing the company to $50m in costs – quite a sum at that time. Mason gets away with being fired for his incompetence. But this is America, fail in one thing and start again is the norm. He is approached by Alan Prosser, a water, sewerage and plumbing man looking for another business partner after the former had gone to Puritan, a food retailer selling pure foods (or at least uncontaminated ones, it is difficult to tell). Puritan is a Syndicate operation (p177). Mason may have been incompetent in reinsurance, but he was always a good salesman, a skill that Prosser does not have. If one can sell insurance, water filters should be a cinch. There is one supplier, in particular, Mitsuyama, a Japanese company. Everyone wants a franchise. But the filters fail and the franchisees struggle.

Typhus, measles, polio, gonorrhoea and enteritis are endemic not because of a reluctance to vaccinate as in the current scenario, but rather because antibiotics no longer work due to their exploitation, particularly in agriculture. People suffer lice, too. There is plenty of scratching going on. Phillip Mason visits the VD clinic for treatment for gonorrhoea only to discover that traces of antibiotic from his meat diet have rendered his strain resistant (p122). Vegetarians eating organic foods fare better. Care is needed not to cut oneself shaving; they can fester. The city rains are acidic. Notwithstanding gonorrhoea, everyone is sick which leads to labour shortages and limited public services.

Internationally, other continents do no better. The Mediterranean is close to collapse. As is the Baltic. There is bottom trawling to catch the deepest sea creatures that might still be fit to eat (p177) – though the trawlers bring up barrels of toxic chemicals as well, just add a few more to the death toll (p180).

There is also an imminent food crisis. A pest known as a jigra is blighting key crops such as potatoes. They too are resistant to known pesticides. It is not clear whether their resistance is evolutionary or the product of some genetic manipulation. Worms are bought in for soil conditioning. One supplier is Plant Fertility. Suspicion is rife about the jigras’ origins. In any case, it is difficult enough growing things when the sun does not shine.

The resistance

Fred Smith is the alias of Austin Train, the notional leader of an environmental movement – the Trainites – fighting the corporate poisoning of the USA. Their calling card is a scull-and-crossbones. He is the author of Handbook for 3000 AD. Some Trainites live in communes known as Wats. They also enjoy khat, a recreational drug that also acts as a natural bacteriacide (p152). It also has constipation as a side-effect. Good for dealing with the symptoms of enteritis, though (p198). Train goes to ground playing dead in LA living as a garbage collector (pp96/7), though 200 other people take on his name, not least Ossie, the brains behind the kidnap of Bamberley’s son and various bombings, one of which actually kills the real Train in a courtroom where he is being tried for the kidnapping! And the motive for the kidnap? In this world, clean water is the most highly desired and valuable of resources. Certain companies hold a near monopoly over water dispensing machines and filters. Bamberley is one of them and the kidnappers want him to install 20 thousand water machines with filters (presumably in places accessible to all). Bamberley is also rumoured to be behind a bombing of the Denver wat (p343)

Another flank of resistance comes from the Tupas, described as US black militants (p228). It seems ok to poison black Africans, less to black Americans.

The lessons to take

I am writing this the day after the current US Prexy, with his zealous head of the now-misnamed Environmental Protection Agency, Lee Zeldin (right), rolled back the Endangerment Finding that enabled the US Congress to legislate to tackle climate change. The Endangerment Finding is based on the scientific determination that carbon dioxide and greenhouse gases are a danger to human health. It dates from 2009.

In Brunner’s USA there is no Endangerment Finding, but there has been little regulation at all when it comes to air and water pollution. There are EVs and “steam” cars; on the latter we are not quite sure how they work, but they do represent alternatives to petrol/gas powered vehicles.

Brunner warns us against the abuse of antibiotics, particularly in factory farming. Bacteria become resistant because of the pervasiveness of antibiotics in common, largely meat-based, foods. Humans’ ability to fight common disease, including sexually-transmitted ones (good to see that infidelity remains a feature of the future). There is no discussion in the book about vaccines and so-called “antivax” sentiment. But the inability to fight common, particularly childhood diseases, should worry us all (at the time of writing, London is now suffering an outbreak of measles due to low vaccination rates). There is actually a point in the book, where it becomes clear that there is perhaps a children problem. It is not about a shortage of them necessarily, but the child mortality rate is increasing. This will become an issue going into whatever future remains.

Brunner’s modern-day billionaires, represented in the book by the male members of the Bamberley family, appear to be philanthropists, but behind their charitable ventures (Nutripon Hydroponics) is the real money makers, oil and war (napalm). Protecting those interests is paramount. There is also “the Syndicate”, characterised as a mafia-type operation that owns Puritan, the organic – or at least uncontaminated – food retailer. Increasingly we learn that what it says on the label is not what is inside, despite paying a premium for the product. There are also some death squads. Men turning up with guns and killing key characters in cold blood. There does not seem to be too much law and order, or maybe just law, in this USA. The billionaires themselves, however, are not protected. The bad air affects all, it is just that they live in airconditioned gated communities. The majority, as Hector found out during his captivity, live in squalor.

The book has three instances of carnage: Noshri, Honduras and Denver. All three have the same source. The contaminant is a thing called “Ergot”. It is a nerve gas that drives people crazy. It is enough to get a boy to murder his sister. Ergot is stored in an abandoned silver mine, but the drums have become rotten and leak. The leakage seeped into the nearby watercourses used for Nutripon production, hence the contamination. The effects are then exported with the product. The Denver riot is caused by the contamination of the drinking water supply. We can extrapolate from this our own predicament. Our water courses are contaminated with PFAs, so-called forever chemicals (they do not degrade when released to the natural environment). UK water courses are also contaminated with both human and animal waste. The human and animal waste both contain antibiotics. The routine use of antibiotics on farm animals and humans undermines the effectiveness of these wonder drugs when we need them.

Food security is another thread throughout the book. Nutripon itself is a famine-busting product specifically designed to feed people facing starvation, or at least malnutrition. In the end it will provide nutrition for millions of Americans as the jigras spread and humanity’s ability to feed itself declines. Fanciful it may seem, but it is not so. Any reader wanting to investigate further can read the work of Tim Lang (left), and in particular his book, Feeding Britain (2020). Lang has long warned of a food crisis, but policymakers do not seem to listen or care. They will, of course, when hunger sets in. But it will be too late by then. A new report from a consortium of academics including those from York and Anglia Ruskin universities have run scenarios on food security. They confirm that social unrest is a very real possibility arising from climate change, war, cyber attacks and supply chain disruption.

The Sheep Look Up does not end on a happy note. The one man thought to be able to challenge the corporate and political powers is dead, murdered by a man who takes his name. The Prexy goes on and presumably also the Bamerberley Trust albeit without the patriarch and his son. Train, before his death, was about to proclaim a solution to the planetary challenges. But before he was able to, the cameraman focused on Train for the live TV transmission was ordered to stop by Prexy. It is rather like Douglas Adams in the Hitch Hiker’s Guide to the Galaxy where a young woman had the answer to humanity’s problems but before she could announce it, the planet was “unexpectedly” demolished to make way for a hyperspace bypass. By the Vogons.

It is difficult not to see Brunner’s book as a prescient warning to humanity, way back. A crazy American president in hoc to powerful corporate interests making money out of suffering and planetary collapse. It is in this sense breath-taking. There are few characters worthy of admiration. Peg Mankiewicz, the investigative journalist, perhaps (though she too dies from the courtroom bomb). Maybe policeman Pete Goddard, the rescuer of the children from the Towerhill avalanche, achieves credit. He seriously injures himself in the rescue. Maybe that is the point, everyone is complicit by virtue of consumption and a failure to act collectively in the interests of a future potential for life on the planet. Maybe the Nutripon madness is what comes to all when society breaks down and food becomes scarce as seen in The Road.

I leave this review with an extract from Prexy’s speech (pp409-411):

…Friends and fellow Americans, no president of the United States has ever had a more melancholy task that I have at this moment. It is my sad duty to inform you that our country is in a state of war. A war that is none of our choosing. And, moreover, not a war with bombs and tanks and missiles, not a war that is fought by soldiers gallant on the field of battle, sailors daring the hostile sea, airmen streaking valiant through the skies – but a war that must be fought by you, the people of the United States.

We’ve been attacked with the most cowardly, the most monstrous, the most evil weapons ever devised by wicked men.We are the victims of a combined chemical and biological attack. You are all aware that our crops have failed disastrously last summer. We, them members of my cabinet and I delayed the release of the truth behind that story in the vain hope that we may contain the threat of the jigras. We can no longer do so. It is known that they were deliberately introduced into this country. They are the same pest which ruined the entire agriculture of Central America and led to the sad and unwished for conflict in Honduras.

That by itself we could endure. We are resilient, brave, long suffering people, we Americans. What is necessary, we will do. But alas there are some among us that bear the name ‘American’ and are traitors, determined to overthrow the legitimate government, freely elected, to make the work of the police impossible, to denigrate and decry the country we love. Some of them adhere to alien creeds, the communism of Marx and Mao; some detestably adhere to a creed equally alien yet spawned within our own borders – that of the Trainites, whose leader, thank God, is safely in jail awaiting his just punishment for kidnapping an innocent boy and imprisoning him and infecting him with foul diseases that endangered his life.

We are fighting an enemy already in our midst. He must be recognised by his words as well as his deeds. Ome of the great cities of our nation today writhes in agony because of the water supply, the precious diamond stream that nourishes our lives, has been poisoned. You may say: how can we resist an enemy whose weapon is the very faucet at the sink, the very water-cooler we go to for relief in the factory or the office? And I will say this! It is you, the people of our great land, who must provide the answer!

It is not going to be easy. It is going to be very hard. Our enemies have succeeded in reducing our stocks of food to the point where we must share and share alike. Following my speech, you will be informed of the emergency arrangements we are putting in hand for equal and fair distribution of the food we have. You will be informed, too, of the plans we have for silencing known traitors and subversives. But the remainder is up to you. You know who the enemy is – you met him at work, you heard him talking treason at a party, you heard about his attendance at the commie-front meeting, you saw the anti-American books in his library, you refused to laugh at his so-called jokes that dragged the name of the United States in the mud, you shut your ears to his anti-American propaganda, you told your kids to keep away from his kids who are being taught to follow in his traitor’s footsteps, you saw him at a Trainite demonstration, you know how he lied and slandered the loyal Americans who have built our country up until it is the richest and most powerful nation in history.

My friends, you elected me to lead you into the third century of our country’s existence. I know you can be trusted to do what is right. You know who the enemy is. Go get him before he gets you!

John Brunner picture: original source unknown, taken from https://www.goodreads.com/photo/author/23113.John_Brunner

Lee Zeldin picture: By Unknown author – https://www.epa.gov/aboutepa/epa-administrator, Public Domain, https://commons.wikimedia.org/w/index.php?curid=159082104

Tim Lang picture: By The British Library – Food Futures: The Choices Facing Us Now at 2:51 and 4:21, cropped, brightened, CC BY 3.0, https://commons.wikimedia.org/w/index.php?curid=125626647

The Revenant and The Road back-to-back

It is fair to say that I am deeply in my dystopia reading period, but it cannot all be about books. With a few hours “free” I accidentally started watching Alejandro González Iñárritu’s The Revenant instead of John Hillcoat’s, The Road. Easy mistake? But I am glad I did because the contrast is fascinating.

The Revenant stars Leonardo DiCaprio as the leader of a group of fur trappers in the literal Wild West (1820s, Dakota) – not the one I grew up with with John Wayne taking on “Indians”. The trappers are guilty of colonising both land and people. In fact the daughter of a chief was kidnapped and, if I understand correctly, ended up being the wife of Glass, DiCaprio’s character, and giving him a son who is, essentially, a trapping apprentice.

The film opens with an Arikara ambush on the trappers. There is gore. A few of them escape on a boat and then trek for quite some time back to the base trading post, Fort Kiowa. But on the way Glass found himself at the end of a grizzly bear’s temper (he is tracking her babies). She mauls him in a graphic 5 minutes of CGI realism. The injured Glass slows the progress of the trekking. It is agreed that one member of the team, John Fitzgerald, stays behind (along with the son, Hawk, and one other young trapper, Jim Bridger) to give him a Christian burial when he eventually dies. And to get paid for it. Fitzgerald is not patient and tries to speed up Glass’ passing. When caught trying to Euthanise him by Hawk, Fitzgerald kills him. He then partially buries Glass and takes the other boy with him.

Glass, however, not only remarkably and improbably survives, but witnessed the murder of his son. The will to survive, then, is driven by revenge. It becomes a classic Western with a familiar denouement. The improbability comes from scenes of self-surgery, extreme cold and wet. Some scenes resemble Bond movies with extended fight scenes. It is immersive, though. One feels the cold oneself. And the dirt is ground in. Notwithstanding the Western theme, this is a story, too, about nature. White humans exploiting it (in contrast to the native Americans). Certainly in that period, nature was to be tamed. A concept that is so familiar to us in the 21st Century. The problem with the movie – and one of the reasons I stopped watching them – is that the underlying narrative is that with enough will, nature can be tamed and overcome. It is fantasy.

Whilst the backdrop to The Revenant is white colonialism, The Road is white decolonialism caused by some environmental catastrophe that ends civilisation. We never get to know what it is, but whatever it is it blocks out the sun so nothing grows. The whole point of existence becomes survival. The road in question is one followed by a man and boy (neither have names) to the coast on the assumption that there is a better life there. Though with no certainty. The passage is hazardous as one route to survival is cannibalism. I was not prepared for this, but I am constantly reminded that food security has been compromised by globalisation and the outsourcing of production to strangers in far away places. We are closer to “cannibalism” than we care to imagine. The Road reminds us that when hungry, people will do anything to survive, even eat one another. At least in the Revenant, food can be scavenged after the wild dogs have taken down a buffalo. In The Road, there are no animals to be scavenged, and by the time Man and Boy are on the road, all the shops and houses have been completely stripped.

In The Road, nature has taken back control. There are no blue skies. It rains relentlessly. The sea is grey. Man in pursuit of protecting his own son is prepared to kill – or bring on the death of strangers. The only compassion comes from the boy. Only the boy wants to share the food they have (accidentally found) with strangers who are equally hungry. The boy can see the transition from being the good guys – defined in terms of not eating others – and the bad guys who do. We are given few signs of hope. The discovery of a live beetle is but one.

After watching the films, I then read the reviews. Peter Bradshaw in the Guardian went as far to say that films like The Revenant are the reason he is a film critic. This was balanced by Carol Cadwalladr’s description of it as “meaningless pain porn“. Maybe that is why she no longer is employed by the Guardian/Observer and Bradshaw is? Bradshaw was less impressed by The Road, saying “I can’t fully share the critical enthusiasm it has widely gained elsewhere because of what seemed to me its fractional reluctance to confront the nightmare fully, though what Joe Penhall’s adaptation arguably does is import into the body of the movie a premonition of the unexpectedly redemptive and gentle tone in McCarthy’s final pages.” I have not read McCarthy’s book and it is not currently on my reading list. But frankly, another scene of cannibalism was not going to make this a “better” film. And like in The Revenant, women remain particular victims. It is they that try to protect the children and in so doing fall victim to hungry men who are, in all probability, responsible for whatever catastrophe caused the fall of civilisation in the first place.

What unites these two movies is the will of men to survive. Glass wants to survive only to avenge the death of his son. Man wants to survive because…we do not give up. There is a better world somewhere. All we have to do is find it. This is also a bit of a strange idea. I implore my students to leave the university and make the world a better place. I don’t say, go on a journey and find a “better” place. For a reason.

Florence – the Grand Tour, November 2025

It is clearly about time. Florence. The Renaissance. History. So, we did it. Monday by train from Munich. Saturday back. We stayed at the Novotel near the airport (see below).

Day 1 – wandering around. Florence is one of those places that if you do wander around you are likely to see everything that is free. Including the reproduction of Michelangelo’s David, left. The original is in the Glleria Dell’Accademia di Firenze and has an entry fee.

Day 2 – the Uffizi gallery. We must go and see Venus at the very least. And the Botticelli pictures more generally. It is a strange gallery. Note that it has ultra-strict security since the bomb attack in 1993. But basically, it is a rectangular building with small galleries off a corridor (right). The building itself dates from 1581. The upper floor is the gallery that comprises a corridor adorned with sculptures and frescoes. It is actually quite difficult to see all of this art without laying on one’s back. And so one wanders around taking in what the senses can appropriate.

There are unexpected surprises such as a smattering of Mannerisms, for example, Portrait of Gabrielle d’Estrées with one of her sisters, Bathing. This image is mischievous but also representative of a mannerist depiction of feminine beauty and fertility. Just oddly included in the collection.

Florence is not complete without the arrival of Caravaggio and his followers with some gruesome depiction of decapitation or similar. The Uffizi does not disappoint offering a themed gallery with my favourite being the Judith Beheading Holofernes by Artemisia Gentileschi. I suppose these pictures very much reflect Renaissance Florence, certainly somewhere violent enough for one’s head to be removed from one’s shoulders without too much effort. Though interestingly conducted by women.

Is the Uffizi a great gallery? It does have a remarkable collection. But I have to admit, I got a bit bored. It would benefit from an edit (I know that it is carefully curated, but…) largely because of the period. There is a lot of replication. Arguably the visitor could do their own edit ahead of time. Though let me put it this way, it is not the Louvre.

Day 3 – we must go to the cathedral (Cathedral of Saint Mary of the Flower) and climb to the top of the famous and unique dome. There are three compelling reasons to do this. First, the roof frescoes cannot be appreciated fully from the ground. Part of the way up the climb to the summit, one gets to walk around the base of the inside of the dome and almost touch them (see gallery below).

Second, your get to walk in between the two structures that make up the dome. The amazing thing about the dome is that prior to its construction there was little understanding about how to make such a structure. The architect Filippo Brunelleschi, such that he was, sort of made it up. He created a secret formula that involves a dome inside a dome. And the staircase to the top walks you between the two structures (left). The precise physics are explained and illustrated with models in the cathedral museum which is also well worth a visit (see gallery below).

Third, on a clear day, there is a spectacular view from the top. I have to say, I was pleased to be able to see the railway station (right). Of all landmarks in a city, the railway station is the one that most captures modernity. In this case, location, bearing in mind the historical roots of the city predating the arrival of the railway, to have it so central speaks loudly. Florence is a city that was embracing and inventing technologies as much as it was doing art (see Galileo Museum below).

Book in advance. Space at the top is limited and it is popular, even in November.

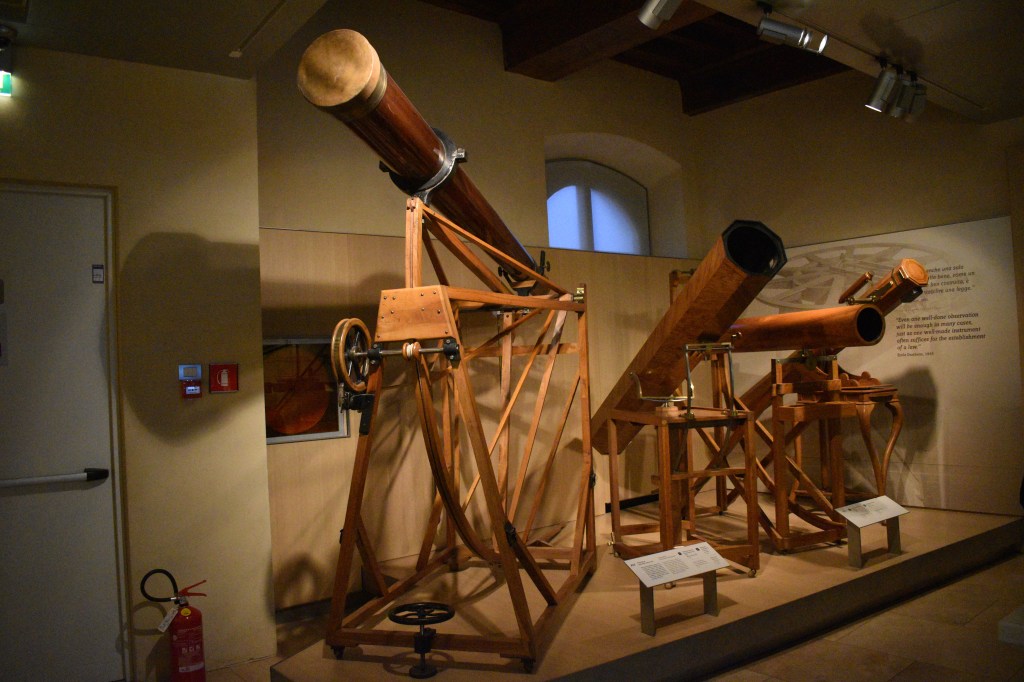

Day 4 – the Galileo Museum.

I have to say, that if visitors to Florence do not patronise this museum, then they are missing out. Plus, it is relatively quiet (though, clearly, it should be really busy). This is a museum packed with analogue scientific instrumentation as art. Functional, yes, but that was never enough for the pioneers – professional and amateur – it had to be beautifully made, whether it be a chemistry cabinet (left) or a timepiece. This museum is packed with artefacts that came out of the Renaissance and beyond that eventually led to humanity’s greatest discoveries facilitating developments that laid the foundation for 20th Century civilisation.

Getting around

It should be easier than it is. Some pitfalls. Buses are unreliable. And in the evening, less frequent. If a bus does not turn up in the evening, it can be a long and uncertain wait for the next one not to turn up. The two tramlines are more reliable, but they too fail. If you have a train or plane to catch, be ready with a taxi number. Probably better to stay centrally (for the train) or at the airport (if flying). Though check that the hotel is in fact at the airport and not just close to it.

Here are some more pictures.

Dome Frescoes

Dome Museum

Galileo Museum

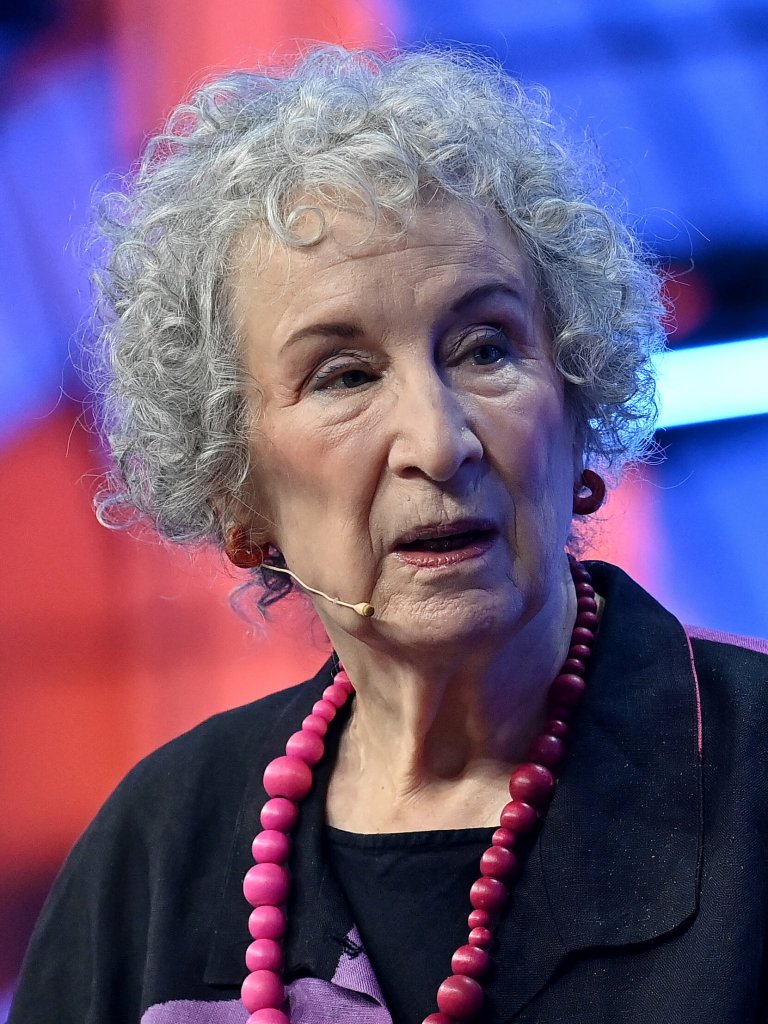

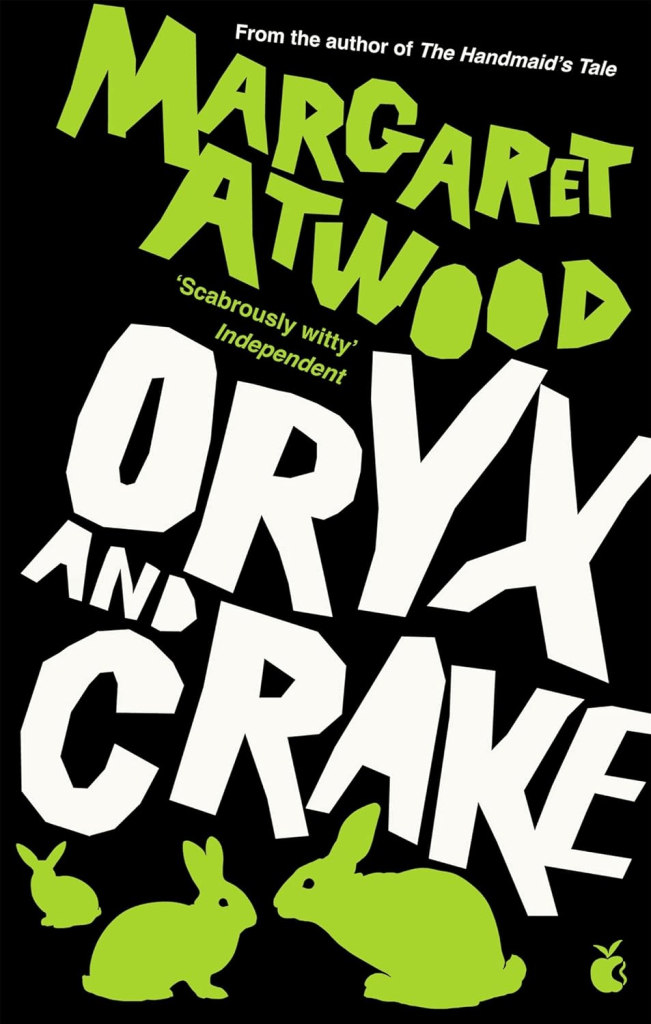

Book Review: Margaret Atwood, Oryx and Crake

This is my first Margaret Atwood (left) experience. I was gripped. And I was taken somewhere not unfamiliar: a dystopian view of the future. Now bearing in mind this book predates Covid-19, it is quite chilling. Bearing in mind this predates Trump and tech billionaires, doubly so. One has to give her credit for what follows. Once again, please note, I am a novice literary critic and my review here has spoilers. This book is also the first part of a trilogy (the subsequent books are not reviewed).

The story is told through the experiences of two men, Crake and Jimmy. Only Jimmy exists before and after the thing that happens to humanity. Jimmy grows up in a family where his parents work for a corporation, HealthWyzer, that, essentially, makes organic life forms. For example, Happicuppa is coffee plants where the beans all ripen together so can be harvested by machines. However, foremost amongst the animal lifeforms are pigoons – pigs that grow organs for human transplant that can be harvested whilst the animals are still alive. Essentially reusable pigs. But there are many other hybrid-type creatures made by corporations: rakunks (make good pets), wolvogs (great guard creatures), spoatgiders (goat-spider – good for bullet-proof vests), rockulets (absorb water high humidity/let it out in low humidity), snats (snake-rats) and crakers (named after their creator) – humanoids that drop dead at 30, bear no malice, enjoy enhanced immune systems…monetisable.

Jimmy and Crake are friends. In their youth, they experience together some of the worst facets of the digital world they inhabit, including violent and gruesome pornography and executions (hedsoff.com). They also play games such as Blood and Roses (pp89-92), a trading game in which players trade atrocities (blood) for human achievements (roses). This game is part of a wider gaming eco-system of Extinctathon monitored by Maddaddam. And it was from this game that Crake got his name which stuck (his real name was Glenn) from an extinct Australian bird. Jimmy’s codename was Thickney from an Australian double-jointed bird that inhabited cemeteries.

Oryx from the title is rescued from child sex slavery and becomes an intimate companion of both characters. Crake, we discover, is the evil genius heading up RejoovenEsense, the ultimate in unregulated mega corporation designing the future. For example, in this world, there is:

“No more prostitution, no more sexual abuse of children, no haggling over the price, no pimps, no sex slaves. No more rape. The five of them will roister for hours, three of the men standing guard and doing the singing and shouting while the fourth one copulates, turn and turn about. Crake has equipped these women with ultra-strong vulvas – extra skin layers, extra muscles – so they sustain these marathons. It no longer matters who the father of the inevitable child will be, since there is no more property to inherit, no father-son loyalty required for war.” (pp194-5)

Jimmy and Crake have very different university experiences. Crake goes to the elite Watson-Crick Institute: “Once a student there and your future was assured. It was like going to Harvard had been, before it got drowned.” (emphasis added, p203). By contrast, Jimmy went to the down-at-heel Martha Graham Academy: “The Academy had been set up by a clutch of now-dead rich liberal bleeding hearts from Old New York as an Arts-and-Humanities college at some time in the last third of the 20th Century, with special emphasis on Performing Arts – acting, singing, dancing and so forth. To that had been added film-making in the 1980s and Video Arts after that.” (p219).

Where Crake after graduation gets access to mega corporations, Jimmy settles for working in advertising for a company called AnooYoo before being invited by Crake to join him to promote their big product, BlyssPluss: The aim was to produce a single pill that, at one and the same time would:

- protect the user against all known sexually transmitted diseases, fatal, inconvenient, or merely unsightly;

- provide unlimited supply of libido and sexual prowess, coupled with generalized sense of energy and well-being thus reducing the frustration and blocked testosterone that led to jealously and violence, and eliminating feelings of low self-worth;

- prolong youth.

What is not on the label is that prolonged use renders one infertile.

In parallel to this we learn of life after the event in which Jimmy, known now as Snowman, lives in the forest and oversees the security of the Crakers that Crake had entrusted to him with in the post-corporate world. This we discover is only possible because of Crake’s scientific intervention that protects him where others perish. Snowman’s life revolves around trying to find food for himself left behind in old settlements – the corporation compounds – amongst the bodies. But venturing further into the forest and towards these places is dangerous. the Pigoons are now feral and themselves hungry. Finishing off what is left of humanity for the sake of a meal would not bother them.

This book is only marginally about climate change. We know it is hot. And we know that perhaps the East Coast USA flooded due to rising sea levels. We know that corporations and their technologies determine the future. And these corporations are in the hands of people for whom profit and power are central to their thinking. They and the corporations they lead are not founded on an overtly ethical platform. Business is simply business. That said, in true Bond villain style, there is more to it. The power to create life forms is balanced by the power to destroy lifeforms, too. Human, in particular.

Critique

On the face of it this is a straightforward dystopia novel. The world is controlled by corporations seeking to refine humanity to secure profit – through idealized/designer babies, disease control/vaccines/organs, human reproduction, etc. There is no real government or regulation. Something catastrophic happens by accident or design. There is no way back. In this case there is a relative peace because there are few other survivors. In many other dystopian novels, civilization breaks down leading to savagery in pursuit of resources.

The parallel stories work well. Atwood does not expect us to understand fully what is going on until quite late – probably at the point at which the two stories converge. The dystopia is plausible now, in 2026, though perhaps not so much in 2003 when it was first published. Though it is not the first dystopia novel. On that basis, it is not very revealing. Maybe it has not aged very well, or maybe it lacks something to say in a way in which 1985’s The Handmaid’s Tale perhaps does.

The friendship between Crake and Jimmy is explored at length. I have to say whilst Crake and Jimmy explore pornography in their bedrooms I, with my childhood friend, marvelled at coloured vinyl records and Matchbox die cast models (two things that we both collected). I will give Atwood credit here; she understands boys and men as well as any male author understands women and girls. I felt the bond between them. It leads neatly to the conclusion. Crake needed someone whom he could trust to protect his legacy in the event of catastrophe (which seems about 90 per cent certain it was planned rather than accidental).

More interestingly is the subtle surveillance state. There is resistance to the corporations with sporadic violence and internment. If I read it correctly, the Maddaddam movement is the focus of the resistance. Both of the main characters are being monitored and controlled arising from their family involvement in the corporations. Jimmy, for example, is often questioned by the pervasive CorpSeCorps armed security forces. They remind him to stay compliant, not least when they show him a video of the execution of his mother, convicted of treason, having rebelled against the corporation and paid the ultimate price (p302). Though in the video her words were clear: “Goodbye. Remember Killer [Jimmy’s pet rakunk]. I love you. Don’t let me down.” (p303).

Once again, then, Atwood is on top of the surveillance state. Something that is now normalized in China and now increasingly in the USA as the corporations take control of our data. The question for me is a simple one, did I need to read 430 pages of Margaret Atwood prose to reveal what is for me self-evident? The answer is, I think, “it depends”. For too long I have avoided fiction and I had forgotten how important it is for creating alternative worlds (the Sci-Fi genre) or at least taking us into the worlds of others who may have had very different life chances and experiences. More critical though is building narrative around relationships – this novel is particularly good in this respect. A number of years ago I was in a book group and we read quite a bit of women’s literature. Actually, that is the wrong term. It is literature that prioritizes the issues relating to women, primarily family and friends. As a younger man, I was quite dismissive of that literature and rebelled, when it was my turn to select a book by foisting on to others work by Will Self, for example. It is good to see here that Atwood can do men. There is only one female character in the book for a reason; namely, the cause of the event that sees off much of humanity is men. And my goodness, we can see that in the contemporary world where three old men in particular seem to engineering dystopia.

Picture: Margaret Atwood Photo by Piaras Ó Mídheach/Collision via Sportsfile

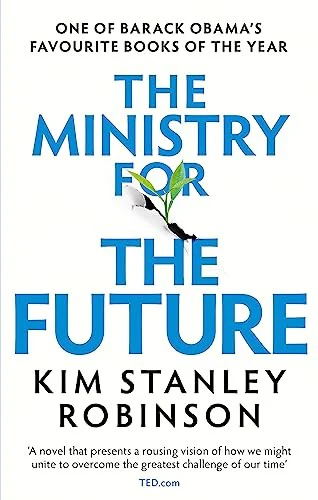

Book Review: Kim Stanley Robinson, The Ministry for the Future

People have different ways of coping with the climate crisis. Quite a few people just ignore it. Others deny it and actively seek to make it worse. Others expect someone or something else to fix it; surely there is a technological fix? I wake up each morning with the challenge in my head. What can I do more to change things?

A response has been to seek solace in art, theatre and music. Indeed, I have a playlist. Every visit to a gallery or exhibition is filtered through the climate lens. And now it is novels – not a medium that I have indulged much. I was never a great reader of novels as a child. When I grew up I immersed myself in non-fiction and newspapers. There is a point to my sudden interest. I have an objective. But first I have to read what are seen as the significant books of fiction that deal with the climate crisis. I also have to learn how to critique literature. This is not a skill that I currently possess. Please bear that in mind when reading. Also note, there are countless spoilers in this text.

My first book to review is Kim Stanley Robinson’s, The Ministry for the Future. It is an epic. The paperback has a small font and has 563 pages. There are two main characters. There is a lot of implicit violence. It is also a book unusual in explaining economic and innovation concepts; for example, discounted cash flow (p 131); the Jevons Paradox (p 165); Gini Coefficient/equality measures (p73); MMT (Ch73); Bretton Woods (Ch50) and the International criminal court (Ch56), etc. There are also free lessons in glaciology and geoengineering amongst other scientific concepts.

The first of the book’s two main characters, Frank May, is an aid worker in Uttar Pradesh. It is 6am and the temperature is already 38 degrees and the humidity 35 per cent. We know that heat and humidity are a lethal combination. And so it proved. When the power failed all life-saving air conditioning shut off. During the course of the next few hours 2 million people died. What we learn from this is that 2 million people is the trigger for action. No state can sit back when 2 million of its citizens die from what is not a natural disaster.

The Indian Government’s near first response was to execute a programme of geoengineering – depositing particulates into the upper atmosphere to deflect the sun and cool the surface. This contravened the Paris Agreement of 2015. No state should unilaterally undertake a programme of geoengineering where the impacts are unknown and cross-border. But they did it.

Frank May improbably survives, but his whole life is haunted by the experience. His post traumatic stress disorder impacts on those around him. His focus is on bringing about change by whatever means. He makes contact with an organisation called The Children of Kali, a direct action grouping that targets the world’s climate villains; namely, those who caused climate change and those who perpetuate it. The bosses of oil companies require 24 hour protection. The owners of private jets do not sleep easy. Diesel ships and aeroplanes will sink or crash on the so-called “accident day”. That, at least, sees an end to mass aviation.

Rejected by the Children of Kali, Frank kidnaps the book’s second main character, Mary Murphy, the head of the recently established UN entity, The Ministry for the Future based in Zurich. He is not very good at kidnapping since he allows the kidnapping to take place in her own apartment, one which is monitored by the local police, she being a target – by the right for threatening their profits or the left for not doing enough to threaten their profits. Before the arrival of the police, Frank confronts her with the “left” position. The Ministry is not doing enough to change things. It is incremental, transparent and easily captured. He tells her about the Children of Kali and the kind of action needed to bring about real change.

On the arrival of the police, Frank disappears through a back window and goes underground until he is eventually apprehended by the police after defending migrants from an attack by local fascists – naturally, immigration is a real flashpoint, and immigrants very much a target. Frank is sent to prison for the kidnapping and his involvement in the death of a man on the beach whom he hit with a large piece of wood.

Scary though the the kidnap experience was, Mary knew that Frank was right. She discussed with her Chief of Staff, Badim Bahadur, whether the Ministry had any black ops, not dissimilar to the Children of Kali. He was not about to disclose any activities of the sort, but the very reticence suggested that the Ministry had such an arm. This, of course, leads to questions about who is responsible for what? Is the Ministry sinking ships or the Children of Kali, or some other radical outfit with little faith in mainstream politics?

A core vehicle for change is the carbon coin. It is discussed extensively in the book. It has key features; for example it has to be supported by central banks, is securitised by the creation of long-term bonds, it is rendered by blockchain technology. It works whereby: “Every ton [sic] of carbon not burned, or sequestered in a way that would be certified to be real for an agreed-upon time, one century being typical…you are given a carbon coin…the central banks would guarantee it at a certain minimum price, they would support a floor so it couldn’t crash. But also it could rise above the floor as people get a sense of its value, in the usual way of currencies in the currency exchange markets.” (p174). It is a form of carbon quantitative easing. And it is a market-driven mechanism.

The carbon coin is based on a paper (actually a series of papers/essays) by Delton Chen (p172 – https://tinyurl.com/4c27dj9a) author of the key paper: Chen, D. B., van der Beek, J., & Cloud, J. (2017). Climate mitigation policy as a system solution: addressing the risk cost of carbon. Journal of Sustainable Finance & Investment, 7(3), 233–274. https://tinyurl.com/5ervkk74

The cover brands the “Ministry…” as “one of Barak Obama’s favourite books of the year”. We all know how important that endorsement has been in recent years. Whilst this may be good for sales, I am not sure if the scenario presented has the legs the author and Obama think and hope for. The first part of the book is apocalyptic, for sure. Lots of bad things happen to people; obviously the heatwave that starts the book results in mass death, but the terrorism/state-sponsored terrorism takes its toll, too. We do not ever get to know who did what. Curiously, the terrorism seems to go without investigation. We do find out who may be behind much of the terror, however; namely, brown people.

The second half of the book simply reassures. Yes, the climate crisis remains present, but the trajectory starts to go in the right direction. Global emissions are cut seriously, not least by the incentive provided by the carbon coin. The scientist innovate in ways that give hope. Though this part is difficult for lay readers like myself to judge relative to the carbon coin initiative (which has at least been subject to peer review). Some of the glacier adaptations do seem fanciful not just scientifically, but also geopolitically. Admittedly, the book was written before the second Trump administration and the current phase of the Ukraine conflict, but even before then, it would have seemed optimistic.

I suppose my biggest misgiving is Robinson’s belief/hope that already-occurring warming can be reversed. Tipping points are recognised, but they do seem to be glossed over. Migration is recognised, of course, but it is still a “problem” to be handled by efficient bureaucracy. There is, equally, not much thought given to food security, biodiversity and shifting global alliances. Without the security of world order, much of what is described in the second half of the book is unlikely to be feasible. And I have no confidence that that world order will be maintained. For example, I worry particularly about food security, centred as it is now around global value chains, limited genetic diversity of core foodstuffs such as grain, rice, bananas, etc. Interested readers should read Tim Lang. Hungry people do not play be the rules. And because of the trajectory, the second half of the book loses its momentum, suspense and mission. For the final few chapters I was waiting for something to happen. But it did not because the author had already determined that the world had been saved and that one of the main characters can actually retire and travel the world in an airship! The book, therefore, has a very long and unrewarding tail.

Anyone needing more – and there is more – should read clever review using an ideal-type approach to criticism, see the work of Solarpunk – Hacker. Worth a good few minutes of your time.

Book Review: Dani Rodrik, Shared Prosperity in a Fractured World

It was a good number of years ago a friend and former colleague of mine recommended the work of Dani Rodrik (left) to me. What I liked about his work was its humanity. He is a rare economist who recognises real-world challenges whist making the case for globalization and its impact on world poverty. That humanity stretches not only to responding to communications but granting me the rights to use some of his intellectual property in my own book at no cost.

So what was it that I thought was appropriate for my own book on Sustainable Business Strategy? Rodrick uses a simple but effective form of challenge: the Trilemma. On one corner is hyperglobalization, on another is national sovereignty and on the third is democratic politics. Democratic politics and national sovereignty are linked together by the Bretton Woods Compromise, an economic system designed to maximise domestic performance, essentially a Keynesian approach. Hyperglobalization and democratic politics are linked together by so-called global governance. Hyperglobalization is a concept that assumes that states are no longer the pre-eminent arbiter of world order. Economics is. States are subjugated to a system of global governance. Finally hyperglobalization and national sovereignty are linked together by the golden straitjacket; namely trade liberalization, free capital markets, free enterprise, etc. Readers will have noted that it is impossible for all three to co-exist. We can have two but not all three. Perhaps the world we live in today is the golden straitjacket with free reign for big tech and nationalism? We can talk about this later.

Rodrik’s Trilemma dates back to 2012 in his book, The Globalization Paradox, though it featured in his blog in 2007. Of course all of this was before the Paris Agreement (2015). It was business as usual. In 2025 it is anything but business as usual. Suffice to say, Rodrik has a new “tri” – this time a trifecta which is equally intriguing. This time at the apex is rebuilding the middle class. This is linked to global poverty reduction with the explanation that at its heart are growth-promoting policies in the North and South, without regard to carbon emissions (equating with Keynesian social democracy + export oriented industrialization). Rebuilding the middle class also links with addressing climate change; i.e. industrial policies and climate clubs among rich nations with discriminatory provisions or, in other words, Bidenomics. And addressing climate change is linked to global poverty reduction through the transfer of technology, jobs and financial resources from rich to poor nations; migration from South to North or, in short, Global Rawlsianism (after John Rawls’ principle that justice requires maximum attention to the needs of the least fortunate – p4).

The trifecta is not a trilemma as we can – and must – at least reconcile the three. And that is what this book is about. However, the paradigm is important here. Rodrik is not a revolutionary. He is very much grounded in a Keynesian/Rawlsian ontology. There is also a splash of technological determinism. By definition he is not a “no-growther”. But neither is he a hyper-globalizer or an economic neoliberal. Growth of sorts provides political stability, resources – financial, human and, indeed, natural. Rich states are mandated to share clean technologies with developing countries and exchange personnel. This is important because straightforward rapid industrialization in developing countries will just release ever more carbon; it is also the case that there are significant challenges and tensions in the trifecta. So Rodrik is a pragmatist, and all the better for that approach. Modern states and economies are so polarised at the moment, anything less than pragmatism leads us to extremes.

Key concepts

Productivism (p155) is another term for industrial policy. It is an industrial policy that can reconcile the trifecta. For example, a policy of carbon reduction through technology. Clearly carbon reduction helps in mitigating climate change by eliminating the main greenhouse gas, carbon dioxide. But it is also good for those other pillars, rebuilding the middle class (larger markets for other nations’ exports and investment as well as reducing outmigration) and poverty reduction (poor countries are disproportionately impacted by climate change – heat, sea-level rise, extreme weather and loss of biodiversity, amongst others). Productivism is, in the end, a shared policy mindset.

Experimental governance (p172) is borrowed from Chuck Sabel and coauthors (right). It is a form of governance that challenges key assumptions about policy implementation: (1) policy makers have clear objectives; (2) uncertainty is low; (3) there is little added value in policy makers communicating with private actors. Bearing in mind my own work on policy implementation, these assumptions do seem misguided. However, working with these assumptions, experimental governance has four elements: (1) goals are set between policy maker and stakeholders; (2) the executing agents are given broad discretion in how goals are achieved; (3) agents’ performances are subject to periodic review and results compared across different experiments; (4) objectives, metrics and procedures pertaining to the experiments are reviewed, revised and disseminated to a broader set of agents. It is iterative.

In academic research, this appears to conform broadly to an action research methodology. Over time, trust and capacity grow as the ideas and initiatives develop and mature.

Some examples

Notwithstanding much Chinese industrial policy featuring experimental governance, Rodrik illustrates the concept with two explicit examples. For the first, he takes us back to the execution of the 1987 Montreal Protocol – an international treaty – that effectively stopped further erosion of the ozone layer directly attributable to the release of CFCs from refrigeration equipment and enabled it to replenish. The scientists behind it – Crutzen, Molina and Rowland (right) were honoured 20 years after their ground breaking work that made the link between CFCs and ozone depletion. Regarding implementation, firms, supported by government agencies including the EPA in the USA, innovated, even if only to avoid regulation more generally.

For his second example, Rodrik draws on a the case of Fundacion Chile (p158) acquiring a small local aquaculture company which imported Norwegian and Japanese salmon farming technology and, in a process of “learning by doing”, developed an entire supply chain from feed to export logistics. The knowledge from this experiment was widely disseminated which literally spawned a salmon farming “rush” enabling exports to go from 300 to 24,000 tons per year in the 1990s.

Whilst both of these examples are illustrative of experimental governance, they both have had significant environmental impacts. Unfortunately we replaced ozone-depleting gases with greenhouse gases. Potent ones. And as for salmon farming, it is not only a huge polluter, but it threatens wild populations through disease and mutation.

OK, I found some weaknesses in two examples. That by no means negates the notion of experimental governance. Far from it. It only shows that experimental governance can be used for good or not-so-good purposes. And to be fair in the case of the Montreal Protocol the urgency meant that we did have to move quickly to find alternatives. Another measure taken was to ensure that refrigeration gases did not get released into the environment, CFCs or not. Salmon farming, however, was always going to be problematic. It is, simply, factory farming. Ultimately when humans put lots of animals together, especially if they are bred for size, disease will follow and, in the case of fish farming, escapes will occur. Factory farms also undermine the effectiveness of antibiotics, one of humanity’s greatest discoveries, now threatened by greed and excessive protein diets.

Three buckets

As a pragmatist and economist of trade, Rodrik offers us four “buckets” in which to put policy options as they relate to globalization (having accepted that hyperglobalization is neither possible nor desirable). Sovereignty will – and perhaps should – always trump international homogenisation.

1

Here we place policies that are “prohibited”; namely those that cannot be part of a viable trading order. Note here that prohibition does not mean that they will not happen. An example would be violating sovereign territory. Sovereign territory is all-too-often violated. More contestable example are policies that are what Rodrik calls, Beggar-thy-neighbor [sic] (BTN), by which he means policies that generate economic benefits made possible by the harm they generate to other nations. Much of the second Trump Administration’s thinking on trade fits here. But more generally here we can place currency devaluations and export subsidies explicitly designed to improve the terms of trade domestically at the expense of other nations.

2

This bucket contains policies that may be amenable to mutual negotiations and adjustments. They may benefit the country enacting them, but the benefits are more widely spread such as potential spill-overs. The mutual benefit part was the basis of WTO most favoured nation status for countries not directly engaged in the negotiations between two nations but achieve a benefit from adjacent bilateral agreements. Here we may also find protective tariffs (protecting nascent sectors or employees in those sectors). It may still generate monopoly rents, but they are incidental, not the purpose. Moreover, affected parties might be expected to respond, but only in proportionate terms and should be directly linked to the damage caused by the state imposing the affecting policy. Equally, export controls on technology destined for countries representing a security threat are not BTN, but they probably will impose economic costs on the importing country (at least until that country develops the technology itself such as may be the case with China and the USA). On this latter point, Rodrik seems agnostic. In summary, states can pursue policies in their own interests subject to them not being explicitly BTN and may be subject to wider negotiation between affected parties.

3

Here we find policies that essentially invite an open discussion about the policies being touted. These are discussions that might not ordinarily take place but can be – what I would call – de-escalatory. We work this out together. Fairly. It might fall out of this bucket if the originating state is unable to explain the purpose, even if it is not BTN.

4

This bucket is for policies that require the agreement of at least two or more states. These are multi-lateral policies where we will find many of the climate change-driven policies. These are negotiations over the health of the global commons, debt resolution and, of course, pandemics. The Montreal Protocol was a bucket 4 agreement.

Making sense of climate change-driven policies

If we start with green subsidies, which bucket? What about China that now has serious advantage in terms of manufacturing and market access. Surely, these subsidies constitute BTN? This requires some logical gymnastics. First, let us step back. Carbon pricing is way too lax. Current prices do not reflect the impact of carbon emissions on the environment and their warming effect. If that is correct – which it really is – then how might we balance the account? We might try to install with haste photovoltaic cells. With a very low price facilitated by subsidies from the Chinese Government, the panels are available in volume to do just that. That is a collective benefit caused by a green subsidy from a country that may have been designed to outprice other countries. However, those countries could have responded with their own subsidies; On the whole they did but rather late and not proportionately (p201). Arguably there was insufficient subsidy overall, not enough rather than too much (as the neoliberals would argue). In the end, subsidies from the Chinese State provided an affordable resource that could compensate for inefficient carbon pricing (and hence emissions reductions, bucket 3). We’ll take that. Bucket 2. I sense it could be bucket 3 if there was an amicability about it, but I am not sure. Suffice to say, Europe has also tried to protect its EV manufacturers against Chinese imports with tariffs. But there is something about the superior technologies being offered by Chinese manufacturers and cost which add to the complexity and the attractiveness of the Chinese product(s).

What about the Carbon Border Adjustment Mechanism (CBAM) introduced by the EU (January 2026)? The EU imposes upon its manufacturers auditing of carbon emissions attributable to the product. Any imports that exceed the maximum allowed have to be paid for with a tariff reflecting the additional carbon emitted in manufacture outside of the EU (defined by the probably inadequate carbon price set under the ETS). It is, of course, a policy designed to change the behaviour of actors external to the EU.

The EU has engaged in this type of trade policy for a long time. It is not just about carbon. Food standards may be captured here. Medicines, toxic materials, exhaust emissions, etc. Is it acceptable? Surely the first job of a (supranational)state is to protect its citizens and if there is evidence that a product is dangerous or deleterious to wellbeing collectively defined, then blocking or controlling it is surely the right thing to do. With CBAM, the EU is trying to protect its citizens against the impacts of a warming planet. In doing so, there is a positive spillover as the atmosphere is a global common. Surely that is defendable? Bucket 2, surely. Or bucket 4 – multi-lateral, if only within the borders of the EU. Moreover, the British responded with its own CBAM (futile really, but proportionate).

What about not trading at all with countries that violate environmental treaties – or indeed those that block treaty ratification? Well, seemingly that is bucket 1. I trust that doing so is against WTO rules – but what are they worth in 2025? Rodrik takes an interesting position with regard to trying to impose barriers against states that have poor worker and human rights records; for example, China’s treatment of the Uyghurs in Xinjiang. Seemingly not in bucket 1 – so, it is allowable. Individual trade agreements could incorporate human/worker rights into the text. Presumably, also, the rights of indigenous people and, by association, the natural environment? And not to forget that the human/worker rights are part of the membership qualification for the EU. But they are hardly definitive and some member states are very much in violation as they progressively dismantle their liberal democratic structures and associated rights. There is no qualification needed for environmental protections, it seems. There could be, if agreed. But it seems very unlikely in the current incarnation of the EU and its parliament. The bigger question though is whether it is something that we must contemplate if we are to mitigate warming and adapt? Maybe the EU as a block could and should?

And one final one. I am just reading Kim Stanley Robinson’s novel, The Ministry for the Future. I will review the book elsewhere, but after serious heatwave in India resulting in the deaths of 2 million people (graphically described in the first chapter), the Indian Government goes ahead with a unilateral policy of geoengineering against a UN agreement that no country would go it alone because the impacts would be global, uncertain and temporary. In this case, geoengineering (depositing aerosols into the upper atmosphere to reflect heat) is in bucket 1. It’s a no-no. It is the violation of sovereign territory. There are many other examples. Damning of rivers has long been contentious and impacting downstream communities. Not to mention water pollution from human waste, fertiliser run-off and industrial processing. More recently, plastic beads (nurdles) and plastic waste more generally cross boarders. Apparel, equally, is exported and often dumped; for example in the Atacama Desert in Chile (right).

Summary

So, where does this take us? Arguably it leaves economists in charge for the time being. However, growing extreme right-wing/fascist blocs supported by the centre-right (as in the case of the EU Parliament and reporting rules under the CSRD) are rolling back efforts to mitigate climate change. To address the challenge something is going to have to give.

Pictures: Dani Rodrik from Harvard Magazine: https://tinyurl.com/5e4d22s9

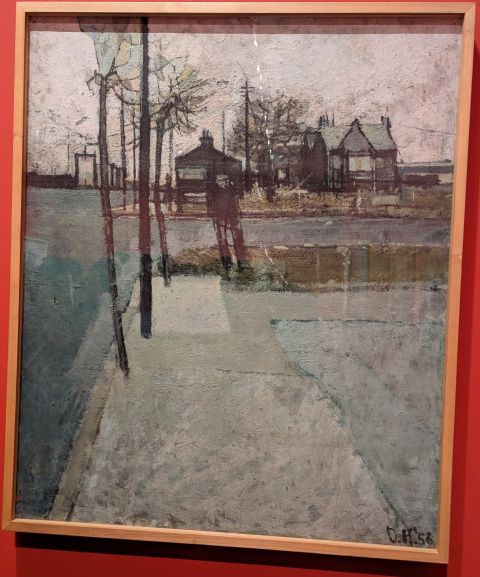

Gilbert and George at the Hayward, Isobel Rock at the Hastings Contemporary

I have to admit, in my 61 years, I have never been to the Hayward Gallery on the Southbank in London. I also have to admit to not taking that much interest in the work of Gilbert and George. It is also true that I do not go often enough to the Hastings Contemporary. Last weekend, myself and my beloved shared the Hayward and Gilbert and George and topped it off with a visit to the Hastings Contemporary. This is what we found.

Gilbert and George, on the face of it, were two graduates of a London art school who found each other because they could not actually find themselves – more specifically, if they were going to be artists, what kind of artists were they going to be? Seemingly starting off quite bohemian (poor) they built a reputation out of performance and then provocative painting – for want of a better term. And everything they needed subject matter-wise was in their neighbourhood; namely, the somewhat salaceous East End of London. There was violence, drunkenness, vagrancy and camaraderie. Oh, and themselves.

The retrospective, then, at the Hayward (until 11 January 2026) charts their digital period. All galleries are filled with huge “canvasses” themed around the above subjects plus slugs (something shared with Isobel Rock). Not forgetting red pillar boxes, phone boxes and rather quaint post marks. Ever present are the artists themselves, always clothed. I used to think they were immaculately dressed, but looking closely they they seem not to own a trouser press.

For those of us of a certain age and nationality, there is much here to celebrate. All of the events, most of them involving violent death (captured in newspaper headlines reproduced like Wahol did with Marilyn Monroe). Their politics were always on the right side of history – indeed, their parents shot fascists (right), but one walks away feeling that the exhibition could have done to have had an editor (Gilbert and George famously curate their own exhibitions).

Because of the size of the Hastings Contemporary, exhibitions are tightly curated. Isabel Rock’s extraordinary work was limited to one room, a couple of walls and a remarkable cupboard (more on this below). Unlike with Gilbert and George, I could have sat with her artworks all day and not get bored or witness every nuance. Her work is fantastical and, crucially, addresses very contemporary issues, primarily climate and consumption.

Climate is so important a theme for her that she went to prison for it. She was one of the protestors in 2023 who climbed on a gantry over the M25 motorway in London to Just Stop Oil. Like so many of her peers, she spent some time in prison for that act. When she emerged, she had significant material for her illustrations. All of her inmates are naked. Incidentally, the aforementioned cupboard a replica of her prison cell which she seemingly shared with a giant slug. She was found not guilty, too.

It is not just slugs, there are rats (enjoying a birthday party), crocodiles – well crocodile-like with extra legs just to wear shoes. Shoes are a feature here. Then there is Pippa Pig – suitably renamed as I am sure the lawyers would have been round otherwise. Pippa Pig is a victim of intensive farming: huge, bloated, tattooed and free. The tables have turned. These pigs eat humans.

There is one masterpiece. It is the one that should detain visitors – there is a bench immediately in front of it for that reason. The picture in question is called Mere Anarchy is loosed upon the World (2024). It is a modern take on Hieronymus Bosch’s Garden of Earthly Delights, but without the heaven. Hell is an Earth of felled or dying trees. What is left is inhabited by grotesque animals doing strange things like playing violins and keyboards, cooking and eating bits of themselves and playing board games. The humans are zombie-fied. The whole scene is looked over by this black female sphynx-like figure taken directly from Niki de Saint Phalle (unknown to me but obvious to my cultured beloved).

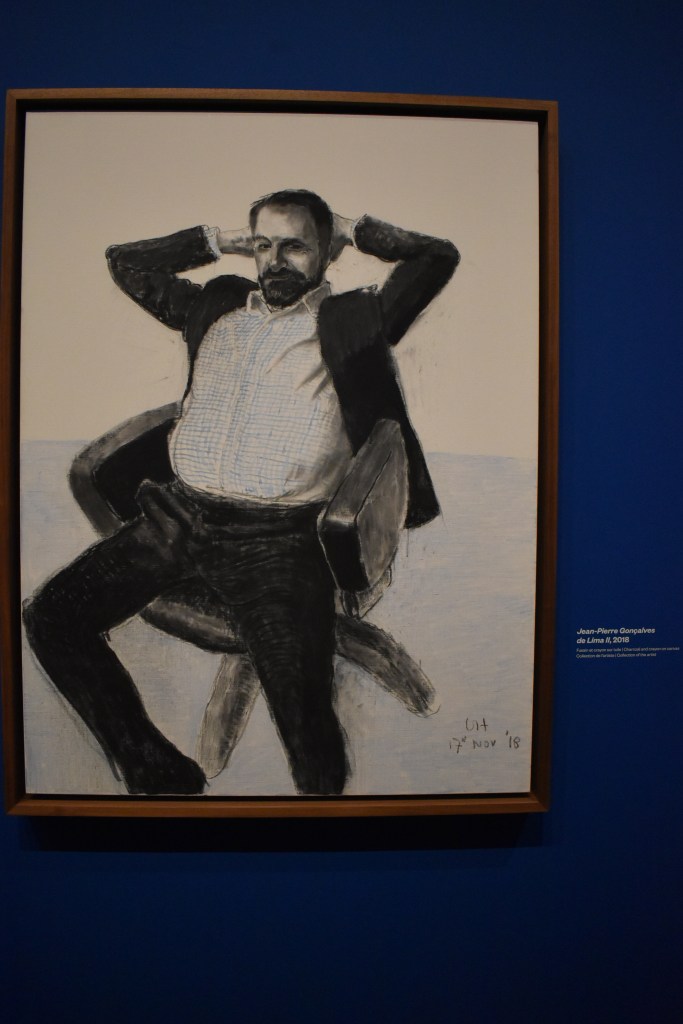

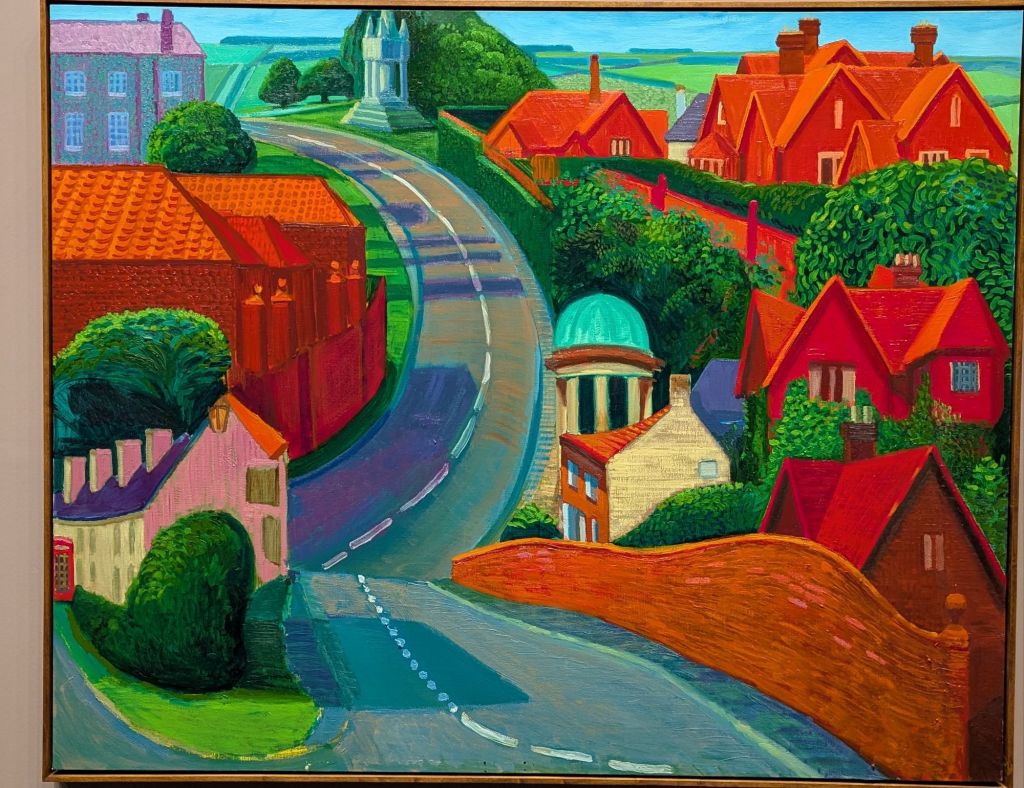

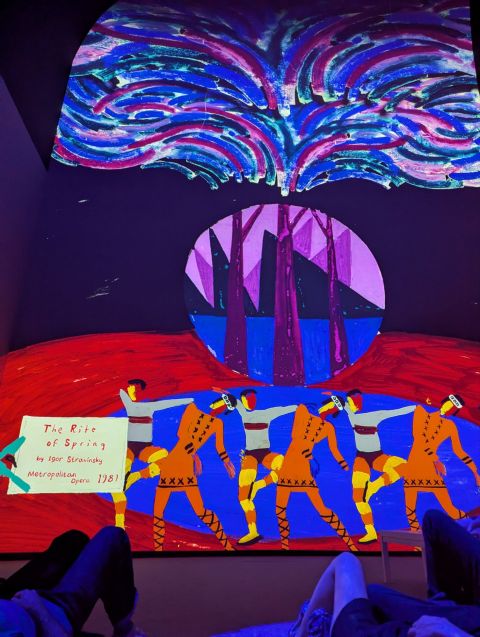

To sum up, the Hayward show is Gilbert and George at scale. It is volume, “look at us”. It is also, to be fair, a retrospective. These do have value, but do beg the question, as I did with the Hockney retrospective at the Fondation Louis Vuitton in Paris, is that it? What about the now? Interestingly none of these artists have children of their own (though Rock says she climbed the M25 gantry for the sake of her nephew and niece). My equivalent is doing what I do for the grandchildren of my wife. It could be that for Rock the art is not enough. For me, teaching without purpose is pointless. Meaning is everything. And because of that, this Hayward retrospective was an exhibition too far. Whilst Rock’s wonderful exhibition was a simple short walk from the front door.

Reasons why voting Labour at the next UK general election is increasingly unlikely

Before I go into my diatribe, here is a counter: https://iandunt.substack.com/p/seven-unrelated-thoughts-about-labours-f9e

Anyway, I have been reluctant to do this, but the list is getting extensive and, come the next election, I need to remind myself why Labour has let me down. The order here is not one of priority. For me, all are as important.

1. Free speech and repressive laws against protest

Proscribing a direct action pressure group (4 July 2025). I have always been a campaigner of some kind. I have disrupted normal life in pursuit of a political aim, usually relating to our treatment of animals and the environment (well before climate change). The idea that any organisation that causes harm only to inanimate objects can be deemed terrorist is dubious to say the least. Maybe the MoD needs to secure its own assets a little better? To get a better understanding of the logic, listen to Bunker podcast from 3 July 2025, here. George Monbiot has also written extensively about the civil liberties implications, too, here.

Allied to that, not repealing anti-union and anti-protest legislation by the previous Conservative government. I know the Government does not want to seem weak and would be attacked by the right-wing press if such legislation was repealed. I can also see that the Government and its ministers may find the repressive legislation useful into the future especially when, because of its ongoing failure and collusion with those causing the problems, people come out onto the streets.

2. Big tech

Palantir – the company controlled by Peter Thiel who is no friend of democracy. His company has aided Trump in tracking immigrants and yet he will access our health records by means of a £330m contract to provide software for the NHS. But more than that, the software has been found to be sub-optimal. In many cases just not as good as what NHS trusts already use. Palantir now has a contract with the police service of the East of England to develop a surveillance network. Starmer seemingly visited the Palantir offices in one of his US visits whilst Mandelson is a keen advocate. This is sinister and a preparation for a war against the people, as we are seeing in the USA.

Then there is Thiel himself (left). Is he really someone who should receive taxpayers’ money? Another venture of his is a betting site called Polymarket on which wagers are made using cryptocurrency ensuring the anonymity of the source of funds. There is plenty of discussion around dodgy wagers made on this site that is not even permitted to operate in the USA.

4. Benefits – are they the problem?

Even thinking about cutting benefits to disabled people (2 July 2025). To borrow from Neil Kinnock, “A Labour Government cutting benefits to people who cannot wash themselves to provide an incentive for them to enter the labour market.” Unconscionable.

5. Lower Thames crossing

Lower Thames Crossing – something in the region of 40 per cent of UK railways have been electrified. In a time of climate crisis, the electrification of the railways would make a considerable contribution to reducing carbon emissions. Alas not. The long-awaited £1.5 billion upgrade of the Midland Mainline between London St Pancras and Nottingham/Derby, Leicester, Sheffield, amongst others, has now been suspended indefinitely. But there is always money for roads, and expensive ones such as the Lower Thames Crossing. Here we go, one 2.6 miles of road will cost £10bn – £1.7bn has already been spent and another £590 has been allocated. The argument is going to be that the Government is seeking private finance to build the road. We shall see, but private roads in the past have come out more than expensive than expected and not a good deal for the Government in charges levied.

6. Carbon capture and storage

Throwing money (£21.7bn) at carbon capture and storage – a technology that has not been deployed anywhere at scale but lobbied for by oil companies (11 October 2024) so that they can carry on polluting. For goodness sake, just cut carbon emissions. The world has changed.

By Allan warren –

Own work, CC BY-SA 3.0, https://commons.wikimedia.org

/w/index.php?curid=12846326

7. Immigration

That speech on immigration in launching the white paper on 12 May 2025 in which Starmer said we risk becoming an “island of strangers” and that net migration had caused “incalculable damage” to British society was way off. He said he wanted to end a “squalid chapter” of rising inward migration. I know that he has subsequently said that he regrets saying this and that he did not make the link between this and Enoch Powell’s rivers of blood speech back in 1968. He’s a lawyer. He knows exactly what he said and the historical connotations. He may regret it but he said it wilfully.

Notwithstanding that, more recent initiatives by the new Home Secretary, Shabana Mahmood, looks to appear even tougher by extending the qualification time for indefinite leave to stay from 5 to 10 years and insisting on A-level standard English language to work in the country. As we saw recently, even prominent MPs cannot spell to the required level.

8. Getting off X

Why does the Government persist in using X, particularly in a week (w/c 7 July 2025) when Grok, its AI assistant, self-identified as Hitler? Even before that, X had been a serious platform for dangerous right-wing misinformation and hate. Or is it only that the perpetrators of this content are indeed just the people the Government seeks to engage with? If it is, it is not working, nor will it. If you want to read X’s excuse, here it is.

9. Anti-trans

The Labour Government has signalled that it is deeply anti-trans. The Health Secretary started in December 2024 by outlawing puberty blockers for children – a tried-and-tested interregnum whilst they get guidance on their identities and body dysphoria. The Cass report recommended their restriction, not withdrawal; that said, the report has been significantly challenged in its methodological and scientific grounding. More recently the puberty blocker obsession has been developed further with a statement preventing GPs from testing blood for hormone (im)balance.

Seemingly the the Supreme Court’s judgment on interpretations of gender under the Equalities Act 2010 “clarified” matters. By which the Government means provides cover for their anti-trans agenda. Transgender is a protected characteristic under that act; however, as interpreted by the court, gender is determined at birth and hence trans people can be misgendered. The practical implications for employers is that they have to provide facilities for trans people as they cannot legally use facilities provided for their *** gender, even if they have a gender recognition certificate. A sensible government may well have read this and realised that the Equalities Act would need to be amended. But no, the Government and indeed the Prime Minister doubled down on this with his spokesman, when asked whether the PM thought that transgender women are women, the answer was “No, the Supreme Court judgment has made clear that when looking at the Equality Act, a woman is a biological woman”. By implication, here the Equalities Act flaw is being normalised rather than corrected. This was then reaffirmed by Kishwer Falkner, chair of the equalities watchdog, The Equality and Human Rights Commission (EHRC), so we are now locked in a debate about toilets, prisons and hospitals when the real issue is bigotry. And to top it all, the Government’s nomination for the new chair of the EHRC , Dr Mary-Ann Stephenson, is gender critical.

Here are a couple of posts by Ian Dunt that captures the complexity and stupidity; https://iandunt.substack.com/p/frightened-and-desperate-ehrc-anti

https://iandunt.substack.com/p/everything-you-need-to-know-about

10. Destructive planning

On planning, my MP wrote the following in response to my concerns that the Planning and Infrastructure Bill would further denude the country’s biodiversity in allowing developers to destroy habitat providing they pay into a fund that would enable compensation sites to be developed that simply cannot replicate what has been destroyed, for example, ancient woodland:

The Planning and Infrastructure Bill is critical to achieving economic growth, higher

Helena Dollimore MP, 7 July 2025

living standards and a more secure future for our country. I am pleased that the

legislation will help to facilitate the building of 1.5 million homes before the next

election. The Bill is also key to making Britain a clean energy superpower, bringing

down bills and securing our energy supply in a more uncertain world. At a time when

we have a local housing crisis and 1 in 27 children are growing up in temporary

accommodation in Hastings and Rye, we have a duty to act.

I too am concerned that 1 in 27 children are growing up in temporary accommodation. I too think we need to build more houses. Affordable ones. This is not, however, the solution to the problem as the problem has been wrongly defined. The problem is the way property has been commoditised – not just in the UK but across Europe. It is why a wealth tax is needed; boomers – and I include myself in this – sit on “assets” (property) that are obscenely over-valued. The value is un-earned. Boomers who bought in the 1970/80s have seen the value (i.e. price) rise faster than anything else in the economy. It is unearned wealth that needs to be taxed. Their value does not reflect the purpose; namely secure homes for families.

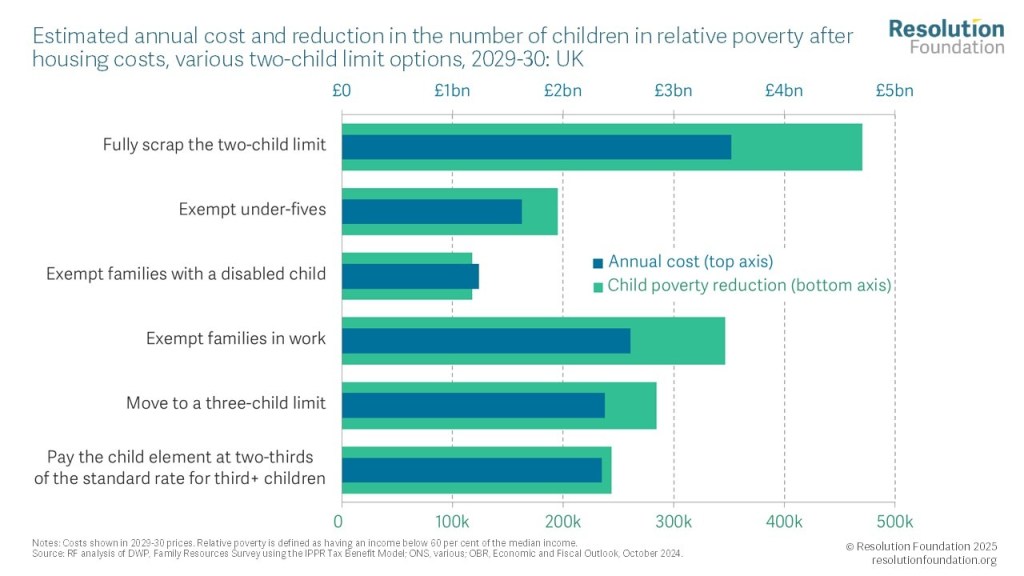

Oh, and whilst I am at it, Government policy itself just makes it worse – the attacks on the welfare system and the failure to fix the 2-child cap on benefit sums it up. My readers can see the impact as presented by the IFS here and more recent evidence/analysis from the Resolution Foundation here (summarised in one graph below). It is also potentially racist as it affect disproportionately ethnic minority families (I trust some people out there think that is a good thing. But I do not). The inequality in our society is at the root of the country’s failure. The Starmer Labour Government does not seem to want to face up to causes. And what about the benefits of children being taken out of poverty – well they do better in life, including education, criminality, health and parenting themselves. It is a false economy.

11. Fuel duty