Archive for the ‘Book reviews’ Category

Book Review: Margaret Atwood, Oryx and Crake

This is my first Margaret Atwood (left) experience. I was gripped. And I was taken somewhere not unfamiliar: a dystopian view of the future. Now bearing in mind this book predates Covid-19, it is quite chilling. Bearing in mind this predates Trump and tech billionaires, doubly so. One has to give her credit for what follows. Once again, please note, I am a novice literary critic and my review here has spoilers. This book is also the first part of a trilogy (the subsequent books are not reviewed).

The story is told through the experiences of two men, Crake and Jimmy. Only Jimmy exists before and after the thing that happens to humanity. Jimmy grows up in a family where his parents work for a corporation, HealthWyzer, that, essentially, makes organic life forms. For example, Happicuppa is coffee plants where the beans all ripen together so can be harvested by machines. However, foremost amongst the animal lifeforms are pigoons – pigs that grow organs for human transplant that can be harvested whilst the animals are still alive. Essentially reusable pigs. But there are many other hybrid-type creatures made by corporations: rakunks (make good pets), wolvogs (great guard creatures), spoatgiders (goat-spider – good for bullet-proof vests), rockulets (absorb water high humidity/let it out in low humidity), snats (snake-rats) and crakers (named after their creator) – humanoids that drop dead at 30, bear no malice, enjoy enhanced immune systems…monetisable.

Jimmy and Crake are friends. In their youth, they experience together some of the worst facets of the digital world they inhabit, including violent and gruesome pornography and executions (hedsoff.com). They also play games such as Blood and Roses (pp89-92), a trading game in which players trade atrocities (blood) for human achievements (roses). This game is part of a wider gaming eco-system of Extinctathon monitored by Maddaddam. And it was from this game that Crake got his name which stuck (his real name was Glenn) from an extinct Australian bird. Jimmy’s codename was Thickney from an Australian double-jointed bird that inhabited cemeteries.

Oryx from the title is rescued from child sex slavery and becomes an intimate companion of both characters. Crake, we discover, is the evil genius heading up RejoovenEsense, the ultimate in unregulated mega corporation designing the future. For example, in this world, there is:

“No more prostitution, no more sexual abuse of children, no haggling over the price, no pimps, no sex slaves. No more rape. The five of them will roister for hours, three of the men standing guard and doing the singing and shouting while the fourth one copulates, turn and turn about. Crake has equipped these women with ultra-strong vulvas – extra skin layers, extra muscles – so they sustain these marathons. It no longer matters who the father of the inevitable child will be, since there is no more property to inherit, no father-son loyalty required for war.” (pp194-5)

Jimmy and Crake have very different university experiences. Crake goes to the elite Watson-Crick Institute: “Once a student there and your future was assured. It was like going to Harvard had been, before it got drowned.” (emphasis added, p203). By contrast, Jimmy went to the down-at-heel Martha Graham Academy: “The Academy had been set up by a clutch of now-dead rich liberal bleeding hearts from Old New York as an Arts-and-Humanities college at some time in the last third of the 20th Century, with special emphasis on Performing Arts – acting, singing, dancing and so forth. To that had been added film-making in the 1980s and Video Arts after that.” (p219).

Where Crake after graduation gets access to mega corporations, Jimmy settles for working in advertising for a company called AnooYoo before being invited by Crake to join him to promote their big product, BlyssPluss: The aim was to produce a single pill that, at one and the same time would:

- protect the user against all known sexually transmitted diseases, fatal, inconvenient, or merely unsightly;

- provide unlimited supply of libido and sexual prowess, coupled with generalized sense of energy and well-being thus reducing the frustration and blocked testosterone that led to jealously and violence, and eliminating feelings of low self-worth;

- prolong youth.

What is not on the label is that prolonged use renders one infertile.

In parallel to this we learn of life after the event in which Jimmy, known now as Snowman, lives in the forest and oversees the security of the Crakers that Crake had entrusted to him with in the post-corporate world. This we discover is only possible because of Crake’s scientific intervention that protects him where others perish. Snowman’s life revolves around trying to find food for himself left behind in old settlements – the corporation compounds – amongst the bodies. But venturing further into the forest and towards these places is dangerous. the Pigoons are now feral and themselves hungry. Finishing off what is left of humanity for the sake of a meal would not bother them.

This book is only marginally about climate change. We know it is hot. And we know that perhaps the East Coast USA flooded due to rising sea levels. We know that corporations and their technologies determine the future. And these corporations are in the hands of people for whom profit and power are central to their thinking. They and the corporations they lead are not founded on an overtly ethical platform. Business is simply business. That said, in true Bond villain style, there is more to it. The power to create life forms is balanced by the power to destroy lifeforms, too. Human, in particular.

Critique

On the face of it this is a straightforward dystopia novel. The world is controlled by corporations seeking to refine humanity to secure profit – through idealized/designer babies, disease control/vaccines/organs, human reproduction, etc. There is no real government or regulation. Something catastrophic happens by accident or design. There is no way back. In this case there is a relative peace because there are few other survivors. In many other dystopian novels, civilization breaks down leading to savagery in pursuit of resources.

The parallel stories work well. Atwood does not expect us to understand fully what is going on until quite late – probably at the point at which the two stories converge. The dystopia is plausible now, in 2026, though perhaps not so much in 2003 when it was first published. Though it is not the first dystopia novel. On that basis, it is not very revealing. Maybe it has not aged very well, or maybe it lacks something to say in a way in which 1985’s The Handmaid’s Tale perhaps does.

The friendship between Crake and Jimmy is explored at length. I have to say whilst Crake and Jimmy explore pornography in their bedrooms I, with my childhood friend, marvelled at coloured vinyl records and Matchbox die cast models (two things that we both collected). I will give Atwood credit here; she understands boys and men as well as any male author understands women and girls. I felt the bond between them. It leads neatly to the conclusion. Crake needed someone whom he could trust to protect his legacy in the event of catastrophe (which seems about 90 per cent certain it was planned rather than accidental).

More interestingly is the subtle surveillance state. There is resistance to the corporations with sporadic violence and internment. If I read it correctly, the Maddaddam movement is the focus of the resistance. Both of the main characters are being monitored and controlled arising from their family involvement in the corporations. Jimmy, for example, is often questioned by the pervasive CorpSeCorps armed security forces. They remind him to stay compliant, not least when they show him a video of the execution of his mother, convicted of treason, having rebelled against the corporation and paid the ultimate price (p302). Though in the video her words were clear: “Goodbye. Remember Killer [Jimmy’s pet rakunk]. I love you. Don’t let me down.” (p303).

Once again, then, Atwood is on top of the surveillance state. Something that is now normalized in China and now increasingly in the USA as the corporations take control of our data. The question for me is a simple one, did I need to read 430 pages of Margaret Atwood prose to reveal what is for me self-evident? The answer is, I think, “it depends”. For too long I have avoided fiction and I had forgotten how important it is for creating alternative worlds (the Sci-Fi genre) or at least taking us into the worlds of others who may have had very different life chances and experiences. More critical though is building narrative around relationships – this novel is particularly good in this respect. A number of years ago I was in a book group and we read quite a bit of women’s literature. Actually, that is the wrong term. It is literature that prioritizes the issues relating to women, primarily family and friends. As a younger man, I was quite dismissive of that literature and rebelled, when it was my turn to select a book by foisting on to others work by Will Self, for example. It is good to see here that Atwood can do men. There is only one female character in the book for a reason; namely, the cause of the event that sees off much of humanity is men. And my goodness, we can see that in the contemporary world where three old men in particular seem to engineering dystopia.

Picture: Margaret Atwood Photo by Piaras Ó Mídheach/Collision via Sportsfile

Book Review: Kim Stanley Robinson, The Ministry for the Future

People have different ways of coping with the climate crisis. Quite a few people just ignore it. Others deny it and actively seek to make it worse. Others expect someone or something else to fix it; surely there is a technological fix? I wake up each morning with the challenge in my head. What can I do more to change things?

A response has been to seek solace in art, theatre and music. Indeed, I have a playlist. Every visit to a gallery or exhibition is filtered through the climate lens. And now it is novels – not a medium that I have indulged much. I was never a great reader of novels as a child. When I grew up I immersed myself in non-fiction and newspapers. There is a point to my sudden interest. I have an objective. But first I have to read what are seen as the significant books of fiction that deal with the climate crisis. I also have to learn how to critique literature. This is not a skill that I currently possess. Please bear that in mind when reading. Also note, there are countless spoilers in this text.

My first book to review is Kim Stanley Robinson’s, The Ministry for the Future. It is an epic. The paperback has a small font and has 563 pages. There are two main characters. There is a lot of implicit violence. It is also a book unusual in explaining economic and innovation concepts; for example, discounted cash flow (p 131); the Jevons Paradox (p 165); Gini Coefficient/equality measures (p73); MMT (Ch73); Bretton Woods (Ch50) and the International criminal court (Ch56), etc. There are also free lessons in glaciology and geoengineering amongst other scientific concepts.

The first of the book’s two main characters, Frank May, is an aid worker in Uttar Pradesh. It is 6am and the temperature is already 38 degrees and the humidity 35 per cent. We know that heat and humidity are a lethal combination. And so it proved. When the power failed all life-saving air conditioning shut off. During the course of the next few hours 2 million people died. What we learn from this is that 2 million people is the trigger for action. No state can sit back when 2 million of its citizens die from what is not a natural disaster.

The Indian Government’s near first response was to execute a programme of geoengineering – depositing particulates into the upper atmosphere to deflect the sun and cool the surface. This contravened the Paris Agreement of 2015. No state should unilaterally undertake a programme of geoengineering where the impacts are unknown and cross-border. But they did it.

Frank May improbably survives, but his whole life is haunted by the experience. His post traumatic stress disorder impacts on those around him. His focus is on bringing about change by whatever means. He makes contact with an organisation called The Children of Kali, a direct action grouping that targets the world’s climate villains; namely, those who caused climate change and those who perpetuate it. The bosses of oil companies require 24 hour protection. The owners of private jets do not sleep easy. Diesel ships and aeroplanes will sink or crash on the so-called “accident day”. That, at least, sees an end to mass aviation.

Rejected by the Children of Kali, Frank kidnaps the book’s second main character, Mary Murphy, the head of the recently established UN entity, The Ministry for the Future based in Zurich. He is not very good at kidnapping since he allows the kidnapping to take place in her own apartment, one which is monitored by the local police, she being a target – by the right for threatening their profits or the left for not doing enough to threaten their profits. Before the arrival of the police, Frank confronts her with the “left” position. The Ministry is not doing enough to change things. It is incremental, transparent and easily captured. He tells her about the Children of Kali and the kind of action needed to bring about real change.

On the arrival of the police, Frank disappears through a back window and goes underground until he is eventually apprehended by the police after defending migrants from an attack by local fascists – naturally, immigration is a real flashpoint, and immigrants very much a target. Frank is sent to prison for the kidnapping and his involvement in the death of a man on the beach whom he hit with a large piece of wood.

Scary though the the kidnap experience was, Mary knew that Frank was right. She discussed with her Chief of Staff, Badim Bahadur, whether the Ministry had any black ops, not dissimilar to the Children of Kali. He was not about to disclose any activities of the sort, but the very reticence suggested that the Ministry had such an arm. This, of course, leads to questions about who is responsible for what? Is the Ministry sinking ships or the Children of Kali, or some other radical outfit with little faith in mainstream politics?

A core vehicle for change is the carbon coin. It is discussed extensively in the book. It has key features; for example it has to be supported by central banks, is securitised by the creation of long-term bonds, it is rendered by blockchain technology. It works whereby: “Every ton [sic] of carbon not burned, or sequestered in a way that would be certified to be real for an agreed-upon time, one century being typical…you are given a carbon coin…the central banks would guarantee it at a certain minimum price, they would support a floor so it couldn’t crash. But also it could rise above the floor as people get a sense of its value, in the usual way of currencies in the currency exchange markets.” (p174). It is a form of carbon quantitative easing. And it is a market-driven mechanism.

The carbon coin is based on a paper (actually a series of papers/essays) by Delton Chen (p172 – https://tinyurl.com/4c27dj9a) author of the key paper: Chen, D. B., van der Beek, J., & Cloud, J. (2017). Climate mitigation policy as a system solution: addressing the risk cost of carbon. Journal of Sustainable Finance & Investment, 7(3), 233–274. https://tinyurl.com/5ervkk74

The cover brands the “Ministry…” as “one of Barak Obama’s favourite books of the year”. We all know how important that endorsement has been in recent years. Whilst this may be good for sales, I am not sure if the scenario presented has the legs the author and Obama think and hope for. The first part of the book is apocalyptic, for sure. Lots of bad things happen to people; obviously the heatwave that starts the book results in mass death, but the terrorism/state-sponsored terrorism takes its toll, too. We do not ever get to know who did what. Curiously, the terrorism seems to go without investigation. We do find out who may be behind much of the terror, however; namely, brown people.

The second half of the book simply reassures. Yes, the climate crisis remains present, but the trajectory starts to go in the right direction. Global emissions are cut seriously, not least by the incentive provided by the carbon coin. The scientist innovate in ways that give hope. Though this part is difficult for lay readers like myself to judge relative to the carbon coin initiative (which has at least been subject to peer review). Some of the glacier adaptations do seem fanciful not just scientifically, but also geopolitically. Admittedly, the book was written before the second Trump administration and the current phase of the Ukraine conflict, but even before then, it would have seemed optimistic.

I suppose my biggest misgiving is Robinson’s belief/hope that already-occurring warming can be reversed. Tipping points are recognised, but they do seem to be glossed over. Migration is recognised, of course, but it is still a “problem” to be handled by efficient bureaucracy. There is, equally, not much thought given to food security, biodiversity and shifting global alliances. Without the security of world order, much of what is described in the second half of the book is unlikely to be feasible. And I have no confidence that that world order will be maintained. For example, I worry particularly about food security, centred as it is now around global value chains, limited genetic diversity of core foodstuffs such as grain, rice, bananas, etc. Interested readers should read Tim Lang. Hungry people do not play be the rules. And because of the trajectory, the second half of the book loses its momentum, suspense and mission. For the final few chapters I was waiting for something to happen. But it did not because the author had already determined that the world had been saved and that one of the main characters can actually retire and travel the world in an airship! The book, therefore, has a very long and unrewarding tail.

Anyone needing more – and there is more – should read clever review using an ideal-type approach to criticism, see the work of Solarpunk – Hacker. Worth a good few minutes of your time.

Book Review: Dani Rodrik, Shared Prosperity in a Fractured World

It was a good number of years ago a friend and former colleague of mine recommended the work of Dani Rodrik (left) to me. What I liked about his work was its humanity. He is a rare economist who recognises real-world challenges whist making the case for globalization and its impact on world poverty. That humanity stretches not only to responding to communications but granting me the rights to use some of his intellectual property in my own book at no cost.

So what was it that I thought was appropriate for my own book on Sustainable Business Strategy? Rodrick uses a simple but effective form of challenge: the Trilemma. On one corner is hyperglobalization, on another is national sovereignty and on the third is democratic politics. Democratic politics and national sovereignty are linked together by the Bretton Woods Compromise, an economic system designed to maximise domestic performance, essentially a Keynesian approach. Hyperglobalization and democratic politics are linked together by so-called global governance. Hyperglobalization is a concept that assumes that states are no longer the pre-eminent arbiter of world order. Economics is. States are subjugated to a system of global governance. Finally hyperglobalization and national sovereignty are linked together by the golden straitjacket; namely trade liberalization, free capital markets, free enterprise, etc. Readers will have noted that it is impossible for all three to co-exist. We can have two but not all three. Perhaps the world we live in today is the golden straitjacket with free reign for big tech and nationalism? We can talk about this later.

Rodrik’s Trilemma dates back to 2012 in his book, The Globalization Paradox, though it featured in his blog in 2007. Of course all of this was before the Paris Agreement (2015). It was business as usual. In 2025 it is anything but business as usual. Suffice to say, Rodrik has a new “tri” – this time a trifecta which is equally intriguing. This time at the apex is rebuilding the middle class. This is linked to global poverty reduction with the explanation that at its heart are growth-promoting policies in the North and South, without regard to carbon emissions (equating with Keynesian social democracy + export oriented industrialization). Rebuilding the middle class also links with addressing climate change; i.e. industrial policies and climate clubs among rich nations with discriminatory provisions or, in other words, Bidenomics. And addressing climate change is linked to global poverty reduction through the transfer of technology, jobs and financial resources from rich to poor nations; migration from South to North or, in short, Global Rawlsianism (after John Rawls’ principle that justice requires maximum attention to the needs of the least fortunate – p4).

The trifecta is not a trilemma as we can – and must – at least reconcile the three. And that is what this book is about. However, the paradigm is important here. Rodrik is not a revolutionary. He is very much grounded in a Keynesian/Rawlsian ontology. There is also a splash of technological determinism. By definition he is not a “no-growther”. But neither is he a hyper-globalizer or an economic neoliberal. Growth of sorts provides political stability, resources – financial, human and, indeed, natural. Rich states are mandated to share clean technologies with developing countries and exchange personnel. This is important because straightforward rapid industrialization in developing countries will just release ever more carbon; it is also the case that there are significant challenges and tensions in the trifecta. So Rodrik is a pragmatist, and all the better for that approach. Modern states and economies are so polarised at the moment, anything less than pragmatism leads us to extremes.

Key concepts

Productivism (p155) is another term for industrial policy. It is an industrial policy that can reconcile the trifecta. For example, a policy of carbon reduction through technology. Clearly carbon reduction helps in mitigating climate change by eliminating the main greenhouse gas, carbon dioxide. But it is also good for those other pillars, rebuilding the middle class (larger markets for other nations’ exports and investment as well as reducing outmigration) and poverty reduction (poor countries are disproportionately impacted by climate change – heat, sea-level rise, extreme weather and loss of biodiversity, amongst others). Productivism is, in the end, a shared policy mindset.

Experimental governance (p172) is borrowed from Chuck Sabel and coauthors (right). It is a form of governance that challenges key assumptions about policy implementation: (1) policy makers have clear objectives; (2) uncertainty is low; (3) there is little added value in policy makers communicating with private actors. Bearing in mind my own work on policy implementation, these assumptions do seem misguided. However, working with these assumptions, experimental governance has four elements: (1) goals are set between policy maker and stakeholders; (2) the executing agents are given broad discretion in how goals are achieved; (3) agents’ performances are subject to periodic review and results compared across different experiments; (4) objectives, metrics and procedures pertaining to the experiments are reviewed, revised and disseminated to a broader set of agents. It is iterative.

In academic research, this appears to conform broadly to an action research methodology. Over time, trust and capacity grow as the ideas and initiatives develop and mature.

Some examples

Notwithstanding much Chinese industrial policy featuring experimental governance, Rodrik illustrates the concept with two explicit examples. For the first, he takes us back to the execution of the 1987 Montreal Protocol – an international treaty – that effectively stopped further erosion of the ozone layer directly attributable to the release of CFCs from refrigeration equipment and enabled it to replenish. The scientists behind it – Crutzen, Molina and Rowland (right) were honoured 20 years after their ground breaking work that made the link between CFCs and ozone depletion. Regarding implementation, firms, supported by government agencies including the EPA in the USA, innovated, even if only to avoid regulation more generally.

For his second example, Rodrik draws on a the case of Fundacion Chile (p158) acquiring a small local aquaculture company which imported Norwegian and Japanese salmon farming technology and, in a process of “learning by doing”, developed an entire supply chain from feed to export logistics. The knowledge from this experiment was widely disseminated which literally spawned a salmon farming “rush” enabling exports to go from 300 to 24,000 tons per year in the 1990s.

Whilst both of these examples are illustrative of experimental governance, they both have had significant environmental impacts. Unfortunately we replaced ozone-depleting gases with greenhouse gases. Potent ones. And as for salmon farming, it is not only a huge polluter, but it threatens wild populations through disease and mutation.

OK, I found some weaknesses in two examples. That by no means negates the notion of experimental governance. Far from it. It only shows that experimental governance can be used for good or not-so-good purposes. And to be fair in the case of the Montreal Protocol the urgency meant that we did have to move quickly to find alternatives. Another measure taken was to ensure that refrigeration gases did not get released into the environment, CFCs or not. Salmon farming, however, was always going to be problematic. It is, simply, factory farming. Ultimately when humans put lots of animals together, especially if they are bred for size, disease will follow and, in the case of fish farming, escapes will occur. Factory farms also undermine the effectiveness of antibiotics, one of humanity’s greatest discoveries, now threatened by greed and excessive protein diets.

Three buckets

As a pragmatist and economist of trade, Rodrik offers us four “buckets” in which to put policy options as they relate to globalization (having accepted that hyperglobalization is neither possible nor desirable). Sovereignty will – and perhaps should – always trump international homogenisation.

1

Here we place policies that are “prohibited”; namely those that cannot be part of a viable trading order. Note here that prohibition does not mean that they will not happen. An example would be violating sovereign territory. Sovereign territory is all-too-often violated. More contestable example are policies that are what Rodrik calls, Beggar-thy-neighbor [sic] (BTN), by which he means policies that generate economic benefits made possible by the harm they generate to other nations. Much of the second Trump Administration’s thinking on trade fits here. But more generally here we can place currency devaluations and export subsidies explicitly designed to improve the terms of trade domestically at the expense of other nations.

2

This bucket contains policies that may be amenable to mutual negotiations and adjustments. They may benefit the country enacting them, but the benefits are more widely spread such as potential spill-overs. The mutual benefit part was the basis of WTO most favoured nation status for countries not directly engaged in the negotiations between two nations but achieve a benefit from adjacent bilateral agreements. Here we may also find protective tariffs (protecting nascent sectors or employees in those sectors). It may still generate monopoly rents, but they are incidental, not the purpose. Moreover, affected parties might be expected to respond, but only in proportionate terms and should be directly linked to the damage caused by the state imposing the affecting policy. Equally, export controls on technology destined for countries representing a security threat are not BTN, but they probably will impose economic costs on the importing country (at least until that country develops the technology itself such as may be the case with China and the USA). On this latter point, Rodrik seems agnostic. In summary, states can pursue policies in their own interests subject to them not being explicitly BTN and may be subject to wider negotiation between affected parties.

3

Here we find policies that essentially invite an open discussion about the policies being touted. These are discussions that might not ordinarily take place but can be – what I would call – de-escalatory. We work this out together. Fairly. It might fall out of this bucket if the originating state is unable to explain the purpose, even if it is not BTN.

4

This bucket is for policies that require the agreement of at least two or more states. These are multi-lateral policies where we will find many of the climate change-driven policies. These are negotiations over the health of the global commons, debt resolution and, of course, pandemics. The Montreal Protocol was a bucket 4 agreement.

Making sense of climate change-driven policies

If we start with green subsidies, which bucket? What about China that now has serious advantage in terms of manufacturing and market access. Surely, these subsidies constitute BTN? This requires some logical gymnastics. First, let us step back. Carbon pricing is way too lax. Current prices do not reflect the impact of carbon emissions on the environment and their warming effect. If that is correct – which it really is – then how might we balance the account? We might try to install with haste photovoltaic cells. With a very low price facilitated by subsidies from the Chinese Government, the panels are available in volume to do just that. That is a collective benefit caused by a green subsidy from a country that may have been designed to outprice other countries. However, those countries could have responded with their own subsidies; On the whole they did but rather late and not proportionately (p201). Arguably there was insufficient subsidy overall, not enough rather than too much (as the neoliberals would argue). In the end, subsidies from the Chinese State provided an affordable resource that could compensate for inefficient carbon pricing (and hence emissions reductions, bucket 3). We’ll take that. Bucket 2. I sense it could be bucket 3 if there was an amicability about it, but I am not sure. Suffice to say, Europe has also tried to protect its EV manufacturers against Chinese imports with tariffs. But there is something about the superior technologies being offered by Chinese manufacturers and cost which add to the complexity and the attractiveness of the Chinese product(s).

What about the Carbon Border Adjustment Mechanism (CBAM) introduced by the EU (January 2026)? The EU imposes upon its manufacturers auditing of carbon emissions attributable to the product. Any imports that exceed the maximum allowed have to be paid for with a tariff reflecting the additional carbon emitted in manufacture outside of the EU (defined by the probably inadequate carbon price set under the ETS). It is, of course, a policy designed to change the behaviour of actors external to the EU.

The EU has engaged in this type of trade policy for a long time. It is not just about carbon. Food standards may be captured here. Medicines, toxic materials, exhaust emissions, etc. Is it acceptable? Surely the first job of a (supranational)state is to protect its citizens and if there is evidence that a product is dangerous or deleterious to wellbeing collectively defined, then blocking or controlling it is surely the right thing to do. With CBAM, the EU is trying to protect its citizens against the impacts of a warming planet. In doing so, there is a positive spillover as the atmosphere is a global common. Surely that is defendable? Bucket 2, surely. Or bucket 4 – multi-lateral, if only within the borders of the EU. Moreover, the British responded with its own CBAM (futile really, but proportionate).

What about not trading at all with countries that violate environmental treaties – or indeed those that block treaty ratification? Well, seemingly that is bucket 1. I trust that doing so is against WTO rules – but what are they worth in 2025? Rodrik takes an interesting position with regard to trying to impose barriers against states that have poor worker and human rights records; for example, China’s treatment of the Uyghurs in Xinjiang. Seemingly not in bucket 1 – so, it is allowable. Individual trade agreements could incorporate human/worker rights into the text. Presumably, also, the rights of indigenous people and, by association, the natural environment? And not to forget that the human/worker rights are part of the membership qualification for the EU. But they are hardly definitive and some member states are very much in violation as they progressively dismantle their liberal democratic structures and associated rights. There is no qualification needed for environmental protections, it seems. There could be, if agreed. But it seems very unlikely in the current incarnation of the EU and its parliament. The bigger question though is whether it is something that we must contemplate if we are to mitigate warming and adapt? Maybe the EU as a block could and should?

And one final one. I am just reading Kim Stanley Robinson’s novel, The Ministry for the Future. I will review the book elsewhere, but after serious heatwave in India resulting in the deaths of 2 million people (graphically described in the first chapter), the Indian Government goes ahead with a unilateral policy of geoengineering against a UN agreement that no country would go it alone because the impacts would be global, uncertain and temporary. In this case, geoengineering (depositing aerosols into the upper atmosphere to reflect heat) is in bucket 1. It’s a no-no. It is the violation of sovereign territory. There are many other examples. Damning of rivers has long been contentious and impacting downstream communities. Not to mention water pollution from human waste, fertiliser run-off and industrial processing. More recently, plastic beads (nurdles) and plastic waste more generally cross boarders. Apparel, equally, is exported and often dumped; for example in the Atacama Desert in Chile (right).

Summary

So, where does this take us? Arguably it leaves economists in charge for the time being. However, growing extreme right-wing/fascist blocs supported by the centre-right (as in the case of the EU Parliament and reporting rules under the CSRD) are rolling back efforts to mitigate climate change. To address the challenge something is going to have to give.

Pictures: Dani Rodrik from Harvard Magazine: https://tinyurl.com/5e4d22s9

Reflections on “The Pie at Night” by Stuart Maconie

It was at least three years’ ago that a colleague lent me this book, knowing full well that I am a regular listener to Maconie’s radio programme, the Freak Zone, on BBC Radio 6 Music. I have finally read it and have some thoughts on its content. Maconie is the same generation as I am and the cultural references are meaningful in a way they would not be for younger people and indeed people not from the North of England.

In the book Maconie discusses – effectively – the leisure pursuits of northerners – music, art, education, museums, fun fairs, eating, walking/countryside, sport/football/speedway/betting. Let me start with music. His Freak Zone show is sometimes inaccessible – or unlistenable. He says of the show’s playlists “[I like what] some people might call ‘weird shit'”. He also likes “well-crafted pop” such as Chic, Abba, disco and Tamla Mowtown. “What I do not like is the stuff in between: middle of the road rock, landfill indie, earnest singer songwriters, self-important rock stars who think they are old bluesmen or great poets, stadium rock bands, divas, legends, anyone who has got to the stage in their career when they now wear a hat thinking it makes them interesting, all the stuff that ends up in those rock critics’ list of the 100 Greatest Albums.” I love some of the phraseology without actually knowing exactly what it means. Landfill indie – I sense I could be partial to a bit of that. Earnest singer-songwriters…I have often struggled with this genre; not least because I wish music changed things, but it does not. Earnest, but fruitless. Anyway, does he mean Bob Dylan (who also wears a hat)? The rock critics’ top 100 albums…as he is a former rock critic, I defer to him on that. Interestingly he then admits to his dislike of opera. He has tried, he says. And then he tries again with Opera North and a performance of The Marriage of Figaro. I have seen some opera at the BBC proms and a little bit in Munich. I have also seen some Gilbert and Sullivan at the English National Opera. A hoot, but I am not sure it is really opera. I will never admit to it being a favourite genre, or anywhere close. It is potentially captivating. One problem is that I’m not so interested these days in stories. I stopped going to the cinema about 10 years’ ago. I just cannot cope any more with people getting hurt. An opera without betrayal and the odd stabbing is not really opera. I know most of it is not real, but even an edition of “Yes Minister” makes me feel bad.

On fun fairs and the places that host them such as Blackpool, I am reassured that people have always gone there to escape from their day-to-day lives (work is illustrated throughout the book from mills to mines). With a fun fair and “white knuckle rides”, the sheer terror is guaranteed to focus the mind – I’ve never been a great fan of such rides. The best I have been able to manage is the Waltzers. The side-shows, too, serve that purpose. I can still remember as a kid shaking hands with the “tallest man in the world”. He did have large hands. On the basis of this chapter, I am going to give Blackpool a pass.

His football chapter takes readers to Rochdale – the club that has never won anything – and FC United, a club that resulted from Manchester United fans who could not endorse the take-over of the club by the Glaziers. They did what was unthinkable for most fans – leave the club (relinquish the season ticket) and set up a new one that would start at the bottom of the most amateur of the amateur leagues. But FC United is a club with ambition – and now its own ground, Broadhurst Park.

Maconie – against a Lancastrian’s better judgment – visits my home town of Hull to go on the Larkin trail, named after the city’s adopted poet and librarian to Hull University’s students. When I lived in the city (from birth until I was 23), we had absolutely nothing to do with the University. I am not even sure that I knew who Larkin was. Or a library for that matter. We lived in the East. The University was in the West and across the river. And for others. So I now know that Larkin enjoyed an occasional drink in Ye Olde Black Boy pub. I confirm it is a dark cave. It is where I used to hold the animal rights meetings until we moved into the much-more welcoming Blue Bell (for animal rights people, that is). Larkin also enjoyed, seemingly, cycling out of the city to places like Broomfleet (Humber flood plain) in the West and the Holderness peninsular in the East. Both as flat as anything. Both always foggy and mysterious. Both offered silence – until my first (and only) Siouxsie and the Banshees gig at the City Hall that gave me tinnitus which remains to this day. Maconie concludes that “I like Hull a lot”.

Maconie is perhaps at his best when taking on the leisure activities that good Methodists like me would never contemplate. For example, where can one bet on crown green bowling? There’s one place, Westhoughton. Through a shabby green door on Wigan Road in the town is “the home of professional crown green bowling”. Inside, everyone knows everyone else – outsiders are easy to spot. The betting is not with bookmakers like at the races, but between punters. They square up at the end of the day having made their bets using a language that needs learning. But if you want to see the world’s best CGB player, Brian Duncan, play, this is where you come. If you dare.

A lot of the north is “if you dare”. I’ve been away for a while and going back can feel alien. I do recall being singled out one time as an outsider, so much must my accent have changed. I said I was born-and-bred. But perhaps leaving was a betrayal. Hull City is my football team. It was not when I lived there. I may be a citizen of nowhere now. Or at least in my head, a world citizen.

Book Review – Super Charge Me: Net Zero Faster by Eric Lonergan and Corinne Sawers

If you have a spare evening, buy this book and join the conversation between two wonderful dinner guests, Eric Lonergan and and Corinne Sawers. That said, I’m not sure that you’d get a word in edgeways, even if you wanted to. I suggest just listening and learning.

In the first instance, the format spooked me. It genuinely is written as a dialogue. The two conversationalists flesh out their arguments – they do not challenge one another, rather they develop one another’s points – or invite further development: “go on…” says Sawers, to avoid a cliff hanger. Unless one is paying absolute attention, it is not clear who is speaking, such is the mutual expertise revealed in the exchanges. The book can be read in one sitting.

This is not, be rest assured, one of those “I’ve read this so that you do not have to” reviews. I have been known to write these. Readers are invited into a conversation that needs full engagement (my copy has plenty of page markers for future reference, top left). In addition, if we are in luck, the shelf life of this book will be short. If we, our governments, and the global community more widely, make the transition, the book will have served its purpose and become a cherished museum exhibit.

I’ve reviewed some other books – Alice Bell’s wonderful, Our Biggest Experiment, for example – that reveal how we got to where we are. What we could have done; how we could have avoided the precipice that humanity has now perched itself upon. Those perspectives inevitably lead to despair and inaction. Lonergan and Sawers are future-oriented. There is little dwelling on the past. They discuss a bright future: one that is fair and safe. Readers do not even have to have that much knowledge about climate change because a couple of to-the-point sentences – to paraphrase Douglas Adams – “avoid all that mucking about in hyperspace” and gets readers up to speed. There is no time to waste. It is just better to start using the language of Super Charge Me straight away: appropriately-named EPICs (extreme positive incentives for change) and Mini Musks (those intractable problems – aviation and cement, for example).

What are EPICs? They are extreme because moderate does not change behaviour. They are positive because the behaviour change cuts carbon emissions. They incentivise (never think about something else when you should be thinking about the power of incentives, says Charlie Munger, Warren Buffett’s long-standing business partner, p172). It is all about change. In particular, change that reduces carbon emissions.

But what are they in reality? I have been led astray, it seems. It has been known for me to advocate carbon taxes. My dirty vehicle is taxed – the vehicle licensing cost is high for that reason and it costs more for my on-street parking than for cleaner vehicles. But I still have it. The incentive to ditch is not sufficiently extreme. I’ve learnt recently, that keeping it is potentially better for the environment than buying a new electric vehicle, thanks to a recent BBC show, Sliced Bread. But this is the wrong thinking. I should not be replacing it, I should be using a substitute. I do not because there is no incentive provided by the relative price of that substitute. For example, to visit my family tomorrow using the train would cost me £153. Even with the high price of fuel, my dirty vehicle could do it for half that cost, and I could take two people and unlimited luggage (it is a van) with me. The substitute, if I read the authors right, needs the EPIC treatment by Government. It is their job to fix the relative price and provide the incentive to switch. More generally, it may need investment in infrastructure to do it (more trains/capacity), a change in work practices allowing slower and shared commutes or fewer and, ultimately, a change in the norms of behaviour – actually it is a bit passé to drive a dirty white van rather than take the train. What, no photovoltaics on your roof?! Etc.

These are obviously EPICs for individuals, but there are EPICs for states. EPICs are responsible for the collapse in the cost of solar/photovoltaics and wind power. My new favourites that are going straight into my curriculum are captured in the Green Bretton Woods and Green Trading Agreements. The institutions of the Bretton Woods post-war agreement include the IMF and the World Bank. In the context of the transition, Lonergan cheekily says that “I am not sure that the World Bank is up to the task” (p144), but credits the designers of the post-war economic system with bestowing upon the IMF a “magic power” that was apparently leveraged in the banking crisis of 2008 and more recently in the global response to Covid-19. This power is manifested in a “special drawing right” (SDR). Readers can discover the magic for themselves, but I would entirely concur with Lonergan that the designers of the Bretton Woods institutions covered all bases insightfully and provided utility well into the future.

Thanks also to the conversation, I now also know about Export Credit Agencies (they’d somehow passed me by). These agencies mitigate credit risk for banks lending to low-income countries. The authors argue that they can be repurposed towards carbon-reducing investments. They have served the fossil-fuel industry well in the past and can serve transition economies well, too, into the future.

The book also provides an strong argument for countering the “stranded assets” challenge. Stranded assets are long-lived assets that, if economies transition to net zero with haste, will lose their value and become redundant before their time. Shareholders will lose money. It is true, they will, but it is not really an argument against stranding them if it makes the difference between a liveable and non-liveable planet. Rather, the losers will be an energy elite who have made lots of money from the carbon economy in the past. Being an elite, they are so few in number and the impact overall is small. There is about $4 trillion locked up in fossil-related assets. A lot to us, but small in relation to overall assets in the global economy.

Be prepared to be (re)educated about how money is created, interest rates, why China is cleaner than it may seem, how to stop free-riding, leveraging state borrowing capability, why inflation is good (within reason), contingent carbon tax, sovereign wealth funds, border taxes and why activism is not futile. And trees.

An evening well spent. And no one noticed the food was vegan.

Book review: Alice Bell’s “Our Biggest Experiment”

The experiment in question is, of course, climate change. It is an experiment because humanity is largely conducting the experiment on itself and seeing what happens. Humanity knows how to stop it, but it seems either too curious about the result of the experiment, or too addicted to the drugs to stop it.

My reading and viewing in recent years has covered most of the themes discussed in this book. Andreas Malm’s book, Fossil Capital, deals with coal (Bell cites the book in recognition of his clinical account). Iain Stewart’s 3-Part TV documentaries, Earth: The Planet Wars and Planet Oil, do climate change and oil pretty well and David Wallace-Wells comprehensively spells out the future scenarios for humanity in his book, The Uninhabitable Earth. Bell adds considerably to my knowledge about gas and, in particular, the quest for light in the night. I am now also armed with a knowledge about meteorology, its origins and purpose (obsessive and competitive individuals and trade).

Climate change as Biography

There is an extensive cast of characters. It is through these that the story is so compellingly told. For example, Joseph Priestly grappled with the question of what is heat. Phlogiston was the “substance” that made fuels (and all else) burn; for example, whale oil, marsh gas, coal were pure pholgiston. Phologiston was eventually dismissed as a serious scientific idea after experiments created water from so-called flammable air (hydrogen) and dephlogisticated air (oxygen). An explosion was expected as the hydrogen should have burned well in the oxygen!

Daniel Fahrenheit who, in 1724, etablished the eponymous scale for measuring temperature based on the temperature of an armpit and a bucket of ice/water (pp56/57). He also popularised mercury as the liquid of choice for thermometers. Thomas Huxley and John Tyndall, a couple of outsiders of science’s aristocracy, who studied the formation and melting of glaciers in the Alps in the 1850s. Tyndall’s work on trapped heat arising from the properties of different gases, however, overlooked the work of Eunice Foote – the first person, in 1856, to observe the heating potential of carbon dioxide (p68), though, as was common in those times, women’s science discoveries were overlooked. Consequently, Foote’s male peers (e.g. Tyndall) were credited and cited.

The cast of characters is wonderfully extensive, and I recommend Bell’s book for its attention to such detail. She tells us who knew whom. Who made the seredipitous discoveries. Who took what money. And so on.

The things we remember in our lifetimes (says a late middle-ager)

Former UK prime minister, Margaret Thatcher, was the Left’s nemesis. For a brief time she was an advocate for green house gas emission reductions. It is what Bell calls Thatcher’s “climate moment”. But it was more than that. As a description, that is more in line with Stewart’s explanation in which Thatcher was eventually nobbled by her party and guided away from a progressive approach to climate transition. As a chemist herself she was affected, like many others, by James Hanson’s 1988 US Senate testimony, Thatcher addressed the Royal Society in which she posited the idea that the Earth was being stressed by population (growth), agricultural practices and the burning of fossil fuels. She described it as potentially “a massive experiment with the system of this planet itself” (p312). A year later she was at the UN calling for an international convention on climate change! However, Bell, probably correctly, rejects the idea that it was the scientist in her that was the motivation for her speeches. Rather it was the Hayak economist in her. Her solution was, of course, more market, more capitalism and less state. She may also have sought to de-leftify climate change!

The oil industry

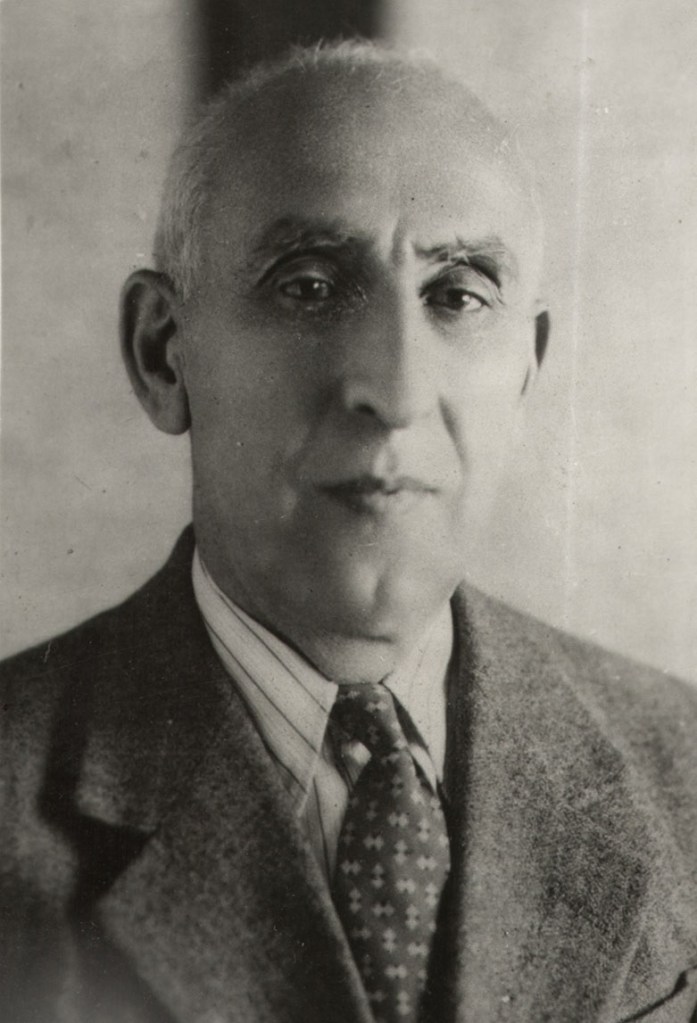

The oil industry is, in many respects the history of empire. BP has its origins in Iran/Persia and had its interests expropriated or nationalised (depending on whether you are British or Iranian). Iain Stewart tells the story of the coup d’etat executed by the British and the Americans to see off the architect of the nationalisation, Iran’s PM, Mohammad Mosaddegh (left), in a campaign of disinformation and public disorder. The nationalisation was executed because the British were not prepared to renegotiate oil concessions in the country and to share the wealth that it generated, as the Americans had done in Saudi Arabia.

Shell/Royal Dutch, too, is founded on Dutch imperialism. In 1890, the Dutch king pledged support for Royal Dutch to drill in the Dutch East Indies (Sumatra). Royal Dutch Shell as a company was the effective takeover of Shell, the British shipping concern of Marcus Samuel (there is a Rothchild Bank story here, too). Though originally it had literally been a shell merchant company. Shell as in crustaceans! The company is the pioneer of the oil tanker and critically, achieved safety approval for its ships to bring oil safely from Asia to Europe through the Suez Canal, mainly, at that time, for lighting. This act outflanked Standard Oil; the rapacious vehicle of J.D. Rockefeller’s wealth generation. Moreover, the automobile had not yet entered to arena and given additional/new value to oil, as electricity was overtaking oil as the main source of artificial light in cities and homes.

Talking of Standard Oil, as is common knowledge, in 1911 the company was ordered by the US Supreme Court to be broken up. Three companies emerged – Standard Oil New Jersey; Standard Oil New York, and Standard Oil California. The latter became Chevron, the New York company, Mobil, and the New Jersey beast became Exxon. Arguably, the breakup was hydra-like with three monsters being created as a result. Exxon and Mobil are now back together, interestingly. Chevron has an unenviable record on climate change (though in 2021 found itself the attention of activist shareholders similar to Exxon).

Exxon has invested considerable sums in climate change scepticism and/or critical science (effectively challenging the the premise of the developing evidence base for planetary warming. The company employed many of the tactics of the tobacco industry before it disputing the causal relationship between smoking and cancer – fighting science with science to spread doubt. This involved employing reputable scientists and the heavyweight PR firm, Hill and Knowlton. The ultimate of regressions.

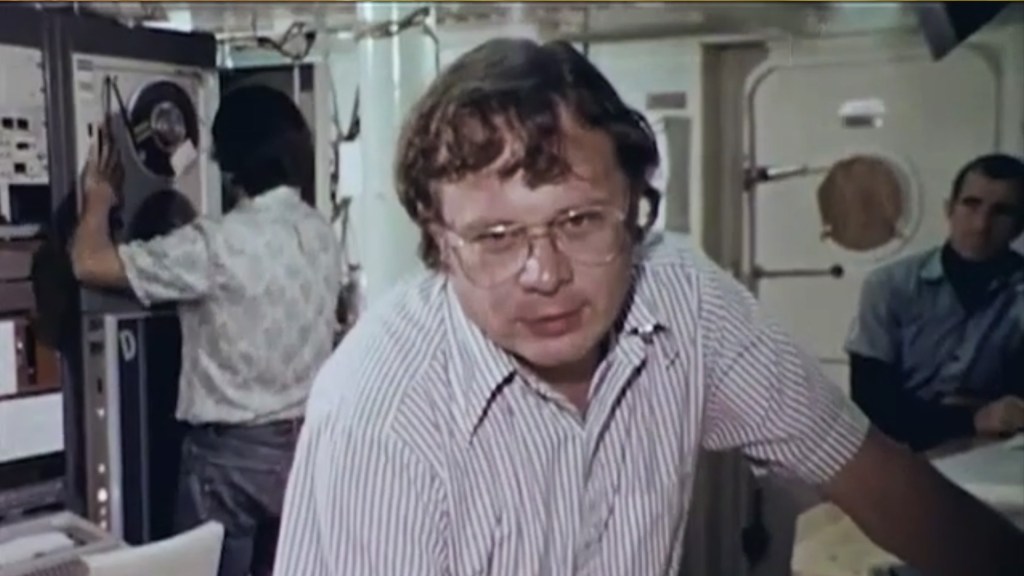

In 1977, Exxon got serious and employed Edward David Jr, a veteran of Bell Labs, to head up their research labs (pp302/3). David was receptive to building a specialist scientific team around carbon dioxide research. The company fitted out a supertanker to do ocean research and brought in Wallace Broekner (left, the man behind the term, global warming, and a reputable climate scientist/oceanographer) and University of Columbia scientist (Doherty Earth Observatory), Taro Takahashi. Bell rightly notes that these scientists did not sell their souls to the Devil as it might seem at first look; rather they may have felt that they could lead Exxon’s transition from oil to renewables. It was not to be.

In the case of climate scepticism there was, notes Bell, a generation of scientists with cold war DNA. Their seeming hatred of the Left arising from marginalisation of military science on campuses around the USA and a residual loathing of Rachel Carson whose book, Silent Spring, saw off DDT whilst simultaneously challenging military strategy (as it was used as a “defoliant” in the Vietnam War). Bell identifies three “angry old men” (p319): Bill Nierenberg (former director of Scipps Institute of Oceanography and veteran of the Manhatten Project), Frederick Seitz (former President of the National Academy of Sciences) and Robert Jastrow (founder of NASA’s Goddard Institute for Space Studies). Together they founded the George C Marshall Institute that initially concerned itself with Reagan’s Strategic Defense Initiative but graduated to climate scepticism as witnessed in the pages of their book, Global Warming: What does the Science Tell Us?

In addition, the company Exxon’s scientists also oversaw the first IPCC (Intergovernmental Panel on Climate Change) report in 1990.

The Road to Now

There is also room for Al Gore (right) in Bell’s account of this period. Gore had had two stints as Vice President of the USA and had more than a look in to make president in the election year of 2000 (controversially defeated by George W Bush and who went on to take the USA out of the Kyoto Agreement, much as Trump did with the Paris Agreement 18 years later). Gore had drawn on the work of the so-called Granddaddy of climate science and oceanography, Roger Revelle. His PhD studies undertaken in the early 1930s examined the extent to which the oceans absorbed carbon dioxide and concluded that it was much less than previously thought and calculated (about 50 per cent and not the 98 per cent accepted wisdom). Revelle was hugely networked, including with the US Navy. He was, in the 1950s, employing a new technique of carbon dating, initially in connection with measuring radioactivity, but equally useful in studying tree rings that revealed isotopes that were closely associated with the burning of fossil fuels. This knowledge was re-applied to oceans by Revelle who had observed a phenomenon called buffering whereby the oceans expel carbon dioxide to avoid acidification. So initial calculations needed to be revisited to capture the significant expulsion and further concentration of carbon dioxide in the air rather than being absorbed by the oceans (p226).

Then there’s Captain Planet (p311), the brainchild of Ted Turner, CNN’s founder. For the 1989 series, he signed up stars such as Whoopi Goldberg, Meg Ryan, Jeff Goldblum and Sting to voice the multi-national characters who appeared in the “Planeteers”. I’ve seen better animation, but it reminds me of shows like “The Tomorrow People” of my youth, featuring a band of kids/young people with special powers, such as telepathy, to help others deal with the agonies of life as well as those regular issues involving extra-terrestrial life (presumably to make the series more interesting). Crucially, the Tomorrow People were unable to take human life. Most of us wanted to be a Tomorrow Person (well I did), but a Planeteer, two decades later, makes a lot of sense. The best I can do is write a blog and teach students climate awareness.

Revelle was a major recipient of IGY (International Geophysical Year – starting June 1957) funding. Imagine this: a funding stream solely dedicated to studying the planet for its own sake and fostering international scientific collaboration (one wonders whether EU funding such as Horizon 2020 is not modelled on the ICY). On 30 June 1957, the BBC actually broadcast a documentary about the ICY called, interestingly, The Restless Sphere.

Alice Bell can be heard talking about her book on the Bunker Daily Podcast (4 July 2021). But this book goes on the reading list for my students because of one particular comment in the conclusion. History matters. It helps us to understand not only where we came from, but what factors got us to where we are today. Bell does this with aplomb. It is important for my students to realise that

[m]ost of us are pretty clueless about how we built this world in the first place, and so struggle to work out where to start rebuilding it. This cluelessness is far from just a problem for energy. It is a price we pay for modernity; there’s so much stuff to know we have to live our lives in a lot of ignorance.

p343

Pics:

Mohammad Mosaddegh – circa 1952/53 By iichs.ir – http://www.iichs.ir/Upload/Image/2017/04/Orginal/e45d0dae_cf8b_45b0_8d37_7af37789d5ff.jpg, Public Domain, https://commons.wikimedia.org/w/index.php?curid=66301280

Standard Oil logo pic: Pat Hawks

Wallace Broekner: https://climatestate.com/2017/04/18/rivers-of-the-sea-global-ocean-survey-studies-geosecs-1975/

Planeteers: https://en.wikipedia.org/w/index.php?curid=10837084 (The Planeteers: Kwame (Africa, power – earth). Wheeler (Brooklyn, New York City, United States: power – fire). Linka (Soviet Union: power – wind). Gi (Asia. power – water). Ma-Ti (Brazil. power – heart)

Book Review: The Box by Marc Levinson

I come from a port city. When I was growing up in the 1970s, the Dockers seemed to be a protected species. They seemed well-off (a relative concept) and always at home. They were on strike often. The history of dock workers and their fight against exploitation through casual labour has been told, but I was not aware of it as a child. I inherited the prejudices against feckless dock workers. Levinson, however, confirms that in England, pay gains by dockers in the 1950s were “robust”. So much so that they earned 30 per cent more than the average male by the 1960s. This is precisely the period of my growing up.

The history of life on the “waterfront” is revisited by Levinson as he chronicles the economic and social history of the shipping container. There’s a paradox. One function of the shipping container mirrored that of the steam engine in capital’s fight with labour. It handed power to plutocrats and oligarchs who owned the specialised ports whilst simultaneously, making the work of dock workers – or those who were left – much safer (docking at its height was more dangerous than construction).

Without the shipping container, globalised supply chains would not have been possible. Prior to containerisation, the Waterfront was a huge cost to exporters and importers. Loading and unloading required a lot of men; and it was skilled, too. A badly loaded ship could capsize. Containerisation brought shipping costs down, considerably. So much so, that it became almost costless – a fraction of the overall costs of production. It enabled a true Ricardian revolution of comparative advantage. Of course, the externalities don’t feature. The use of dirty and carbon-laden fuels in ships is on no ledger.

Levinson details the machinations of port employers, unions and shipping companies. It is a story of men with egos – union leaders in New York and New Jersey on the east coast, and their counterparts on the west coast (LA and San Francisco). It is a tale of rejecting mechanisation and fraught negotiations (and strikes) over how many men not only each ship needed to be unloaded, but how many men per hatch. There’s a huge cast of sometimes unsavoury characters to keep track of. It is a story of demarcation – labourers vs crane drivers – and the difference between negotiating to get the best compensation for members’ job losses and negotiating to keep all men in work (on the west coast, the union negotiated a compensation scheme that enabled many men to retire, which was a most welcome opportunity after a life of hard dock labour). It’s a story of competitive politics resulting in public investment in NY Harbor’s piers and creaking and congested supporting infrastructure by politicians trying to maintain their own privilege but failing to see that the future was different and the investment was misplaced. Because all the while, the shipping companies – two in particular – were developing their own docking facilities on virgin land for the logistics of international containerisation.

There was a huge problem, however, preventing the diffusion of containerisation globally. There were no standards. There were firms that had invested in their own standards such as Sea-Land in New York, owned by one of America’s most iconic of entrepreneurs, Malcolm McLean, who constantly outflanked competitors, legislators and dock workers. McLean’s success was one of ad hoc decisions. “Find me someone who can design and build me a crane in 3 months” sums up this approach. By contrast, a west coast shipping company, Matson Navigation Company, a transportation and sugar conglomerate, took a very scientific approach under its President, John E. Cushing. Cushing brought in a university professor to consider holistically the business of containers – from the containers themselves, their loading, fitting, hauling, lifting, to the ships that would carry them and the trucks that would haul them. To use Levinson’s words “Matson moved deliberately. Pan Atlantic [Sea-Land’s original name], under McLean’s control, was a scrappy upstart building a brand new business, and it risked little by acting quickly.” (p80).

Standards

An upstart though McClean may have been, he did patent his design for a fitting device that locked containers into place in ships, on trucks or next to one another. If agreeing on a standard size of containers was not painful enough involving a cast of technocrats from organisations such as the ISO, The American Standards Association, The National Defense Transportational Association, The United States Maritime Administration (Marad), the fittings debate was fraught. These standards-setting bodies locked horns with the transportation firms and manufacturers of trailers such as Fruehauf – still a familiar name – Strick Trailers and the National Castings Company. The outcome was a classic fudge because an international standard had to reconcile global differences, whilst enabling firms that had already invested in containers not to lose too much money in converting their existing operations. McLean released his patent. It was then hastily modified over two days in Utrecht where the drawings for the final fittings were made in preparation to be presented to the ISO committee meeting in The Hague on 24 September 1965. That was not quite the end of the story. The new standard had never been tested, so when used on ships or trains they failed. Another group of engineers were needed to add strength to the design. In June 1967, the new design was approved much to the chagrin of existing transportation firms that had invested heavily in the old standard. Lesson – don’t approve standards in haste.

There’s more on standards, but not for this review. I had not realised just how much regulation the freight industry was subject to in the USA at this time. Freight bosses had to be as adept at navigating these restrictions as they did the roads and waterways. There were regulators trying to enforce “fairness”, operators trying to work with and around them, and politicians intervening. The rail companies were hidebound by both regulation and non-standardised gauges. But there were innovations, some of which still run today. A number of these companies rejected containers and provided unique services. The Trailer Train, for example, was an innovation in putting truck trailers on trains. It was run by the Pennsylvania Railroad between Chicago and St Louis starting in 1954. It also innovated in inviting all other rail operators to join creating economies of scale and a standardised operation including revenue collection and sharing. As is ever for these operators, they had legacy stock – boxcars, in particular – that would be redundant if containers were adopted.

In Europe, rail operators were keen to facilitate containerisation. In the UK, British Rail sought to develop freight out of Felixstowe; German and French national rail operators out of Bremerhaven. Rotterdam and Antwerp, were also developing their container operations. Seemingly containers bound for the United States were full of whisky!

And then something I had not really thought about, but troubles me as I write. Malcolm McLean’s success – like many of his ilk – was built on amorality. Business is business. What is legal is to be pursued. In the early years of the container revolution, the Vietnam war was ramping up. With 60 thousand soldiers in the country, the supply lines were vitally important. Vietnam had very poor infrastructure and only a single deep port, Saigon. Military logistics were struggling. McLean said he could he help. McLean transformed the fortunes of a second deep port, Cam Ranh Bay. Before McLean arrived, US military logistics had towed a DeLong pier – a whole 300ft pier – from North Carolina through the Panama Canal and across the pacific to be sunk into the bay. It was then re-inforced to support McClean’s monster cranes, suitable for lifting containers full of armaments and, separately, refrigerated foods.

The operation was hugely profitable for McLean, made more profitable when McLean opted to return to the USA via two Japanese ports, Tokyo/Yokohama and Osaka/Kobe to fill empty containers with consumer electronics. This was, apparently, a typical McLean venture – off the cuff. He is alleged to have simply said, “does anyone known anyone at Mitsui”? Two weeks later, a delegation from Mitsui was inspecting the Sea-Land docks in Newark, New Jersey. Profit and business notwithstanding, Levinson is bold enough to state that without McLean a sustained war effort by the US in Vietnam would have been unlikely. Knowing what we know now, that would perhaps have been a good thing? McLean actually enabled and prolonged the war.

McLean was also behind the development of one of England’s foremost container ports, Felixstowe. Similar to Sea- Land’s development of the container facility in Newark, NJ, Felixstowe was not encumbered by union agreements. it was a small and private wharf dealing with grain and palm oil. In 1966, Sea-Land reinforced the wharf and built a container crane at the fraction of the cost of the Tilbury (London) docks. By 1969 it was the 9th biggest container port (by volume) in the world. Leading the way in Europe was Rotterdam with its deep water, co-operative labour unions and necessary post-war reconstruction.

Supply chains – just-in-time delivery

The shipping container was a driver of globalised supply chains. For as long as shipping costs were high, cheap labour and other resources could not realistically be harnessed. As shipping containers got bigger and ports enabled “inter-modality” and computerised loading and unloading, the unit costs of each container went down, driving trade, economic growth and consumption. The containers became mobile warehouses rendering inventory stock outdated. And one-time empty containers being returned found themselves full of commodities such as soya and even grain. We are also at liberty to think about all of the waste – often public – associated with building container ports. Many were developed without tenants – and never got any. Others did, but tenants migrated to other ports with better facilities or access. These were all paid for by taxpayers. Our consumer products could have been even cheaper had ports and regions not speculatively competed with one another.

Climate

Whenever I read books and non-fiction in particular – I am on the look out for environmental factors; acts that become normalised and pushed back nature. Sea-Land’s enormous container operation in Newark, NJ, is a case in point. I have subsequently viewed the area courtesy of Google. It even has a massive Amazon warehouse on it. The development was described in a very matter-of-fact way. The marshland that it colonised was “waste”. Though we know now that it was probably rich in wildlife that was displaced by the development. However, maybe there is a slip of the pen on page 263 in reference to Oakland, CA:

“…a timely $10 million grant from the federal Economic Development Administration, intended to generate jobs in the depressed city, supplied construction funds. A new terminal was rushed into construction, without a tenant, before new environmental regulations took effect.”

I say “slip of the pen” because I cannot gauge whether Levinson thinks that beating the regulation was a good move or not. Certainly if the development was assumed to have violated forthcoming environmental regulations, then it was not good. And those behind it, knew it. That is a story of environmental destruction, the world over through time. Those who do it, know what they are doing. They know what the impacts are, and they still do it.

The only silver-lining I could find was – cutting a long story short – McLean invested also in land. One piece of land was bought to turn into an intensive pig farm. When the shipping going got tough, the land had to be sold, it is now a park. No pigs.

Levinson’s book is one of these master works. it needed to be written. And it was done well. It is a social history told through the development of a familiar artefact. We are all part of its story and we of it’s. A metal box.

Pictures:

Ever Given By Robert Schwemmer for NOAA’s National Ocean Service – Flickr: Container Ship, CC BY-SA 2.0, https://commons.wikimedia.org/w/index.php?curid=19073448

Book Review: What Would Nature Do? by Ruth DeFries

This book essentially says, if humanity had paid more attention to how nature deals with the uncertainties of life on Earth, then we might have avoided some of its calamities – for want of a better word. Of course, there are two so-called calamities afflicting humanity at the moment; namely, a global pandemic and climate change.

One can often tell the whether the author truly has something to say in the final chapter. Can the content be summarised and rendered coherent? Does it hang together? In this case, I am not entirely sure. In fact, the author herself admits it:

In a fit of writer’s block for this final chapter, I ventured downtown to the New York Public Library to see for myself the tiny Hunt-Lenox globe with medieval-style etchings of dragons and strange sea creatures…etched pictures of dragons and monsters signalled seas and lands not yet seen by European eyes, although other peoples had lived in those lands for eons.

(p151)

The dragons, of course, represent all of the things that humanity has not yet discovered. But in getting to where humanity sits currently, the global commons have been well-and-truly “over-grazed” and pathogens serially mis-managed, despite the lessons of history, let alone nature. I’ll return to the calamity shortly, but DeFreis does discuss what humans have learned, though probably inadvertently.

Ancient trees had arteries and veins in their leaves that if severed by a pest – or just something that ate them – the effect on the overall plant would be significant in a detrimental way. The ancient tree is the Gingko, which eventually evolved a toxin to put off insects. But other plants and trees evolved alternative approaches such as “loopy veins”. In the event of part of the leaf succumbing to insect lunch, the sugars created in the leaves could still be delivered to the rest of the tree because they could be re-routed. The most obvious human-created analogy of this is the internet’s packet system whereby the data generated by this blog are put into small packages and sent on their way, often taking different routes and then reconstituted in the reader’s computer and browser. However, much of the human world is hub-and-spoke; i.e. centralised. When things go wrong, bottlenecks occur and all things – commodities, manufacturing components, finished products, foodstuffs – get jammed. In the case of food, hunger ensues.

DeFreis (right) writes extensively about pathogens and viruses in the human and animal world. In the human world, in the absence of politicians, viruses have been dealt with and eradicated by science on the one hand, and (disease) management on the other. Management here is track-and-trace as well as equitable global distribution of vaccines and other technologies. As with Covid-19, no one is safe until everyone is safe. However, we can learn from ants, bees and termites. Ants, famous for living cheek-by-jowl, secrete disinfectant into their nests collected from wood resin. Termites spread their own faeces in their nest benefitting from antimicrobial properties (that seems counter-intuitive). Bees can kill pathogens by flapping their wings! And so on. Ultimately, though, highly social creatures can isolate their kin should they succumb to disease. Primarily, this is to protect the queen and not for the benefit of the sick individuals.

Moving on from viruses and disease, DeFreis talks about the commons – the atmosphere, the seas, water and land. I had not previously been aware of Garrett Hardin, a man who believed that the solution to the commons was to de-commonise them, enclose them and “protect” them from over-exploitation. DeFreis counters his work with a celebration of the studies of Elinor Ostrom who demonstrated that human beings can adequately manage and protect the commons. They do not need permission by a central authority. However, one size does not fit all; what works in one place, does not in others. This is, of course, part of the problem. People have to be given the space and time to work things out, set quotas and agree sanctions for those who either free-ride or break the rules.

Talking about breaking the rules, I had equally not previously been aware of the Biosphere experiment in Oracle, Arizona, back in 1991. Three men and three women entered a CELSS – closed ecosystem life support system – and stayed there for two years testing whether it was possible to replicate the Earth’s life support systems (with a view to building one on the Moon or a planet). It was funded by a Texan billionaire, Edward P Bass, the Elon Musk or his time, perhaps. It took 11 years to build. Nothing that was not already in the CELSS when they entered would be added. It was not plain sailing – crops were blighted by pests and the air became thin as the plants generated carbon dioxide and oxygen mysteriously disappeared.

And so back to what nature would do. Nature is parsimonious. The limiting factor is always energy. All energy is derived from the sun. First in plants, then animals and humans. Most animals conserve as much energy as they can. Certainly through a winter, food can be in short supply. However, nature also builds in redundancy. Those loopy leaves use more energy to build, but when under attack, they are a life saver. Some humans have adopted this principle in their products. Most aeroplanes have redundancy – if one part fails, another kicks in. Apollo 11 would not have made it to the moon had it not been for Margaret Hamilton’s redundant computer code! But our economy is parsimonious – global supply chains do not react well to disruption, something that is increasingly occurring.

Our economy is different in another way, too. It is extractive. Its whole rationale is perpetual growth. Its metrics – productivity, GDP – are just wrong. They perpetuate the extraction and ignore wellbeing. Moreover, instead of generating energy sustainably – from the sun as plants do – we draw on stored reserves of energy in fossil fuels. Growth is only possible by doing that. Nature does not do that. Nature is not capitalist. It does manage its commons – or it did until homo sapiens disrupted the equilibrium. DeFreis does not engage with this. The reality of an economic system that destroys not only itself by undermining the life-support systems of the planet is glossed over. There is no system change needed, only a closer attention to what nature would do.

I can see why this is not tackled. Authors who do end up being criticised like Andreas Malm was on publication of his book, Corona, Climate, Chronic Emergency. It is not pretty. But neither is climate change.

Pictures: